Read and download free pdf of CBSE Class 10 Economics Money And Credit Worksheet. Students and teachers of Class 10 Social Science can get free printable Worksheets for Class 10 Social Science Chapter 3 Money and Credit in PDF format prepared as per the latest syllabus and examination pattern in your schools. Class 10 students should practice questions and answers given here for Social Science in Class 10 which will help them to improve your knowledge of all important chapters and its topics. Students should also download free pdf of Class 10 Social Science Worksheets prepared by teachers as per the latest Social Science books and syllabus issued this academic year and solve important problems with solutions on daily basis to get more score in school exams and tests

Worksheet for Class 10 Social Science Chapter 3 Money and Credit

Class 10 Social Science students should download to the following Chapter 3 Money and Credit Class 10 worksheet in PDF. This test paper with questions and answers for Class 10 will be very useful for exams and help you to score good marks

Class 10 Social Science Worksheet for Chapter 3 Money and Credit

MONEY AS A MEDIUM OF EXCHANGE

A person holding money can easily exchange it for any commodity or service that he or she might want. Thus, everyone prefers to receive payments in money and then exchange the money for things that they want. Let us take the case of a shoe manufacturer. He wants to sell shoes in the market and buy wheat. The shoe manufacturer will first exchange shoes that he has produced for money, and then exchange the money for wheat. In the earlier scenario of barter system, the shoe seller would have to look for a wheat seller who also wants to buy shoes.

Barter System: The barter system was used before the advent of money. People used to exchange one thing for another in this system.

Double Coincidence of wants: The double coincidence of wants is the major drawback of the barter system. It can be very difficult to find people who can fulfill this condition. What one person desires to sell is exactly what the other wishes to buy. In a barter system where goods are directly exchanged without the use of money, double coincidence of wants is an essential feature. In contrast, in an economy where money is in use, money by providing the crucial intermediate step eliminates the need for double coincidence of wants. It is no longer necessary for the shoe manufacturer to look for a farmer who will buy his shoes and at the same time sell him wheat. Since, money acts as an intermediate in the exchange process, it is called a medium of exchange.

MONEY

- Money is a means by which we can get something in exchange. Initially, coins came into use. The coins were initially made of precious metals; like gold and silver. When the precious metals became too precious, ordinary metals began to be used for making coins. Paper money or currency notes gradually took place of coins; although coins of smaller denominations are still in use.

- The currency notes and coins are issued by the government or an authorized body. In India, the RBI (Reserve Bank of India) issues currency notes on behalf of the Union Government. On the Indian currency note, you can find a statement which promises to pay the bearer the amount which is mentioned on the currency note.

- As per Indian law, no other individual or organization is allowed to issue currency. Moreover, the law legalizes the use of rupee as a medium of payment that cannot be refused in settling transactions in India. No individual in India can legally refuse a payment made in rupees. Hence, the rupee is widely accepted as a medium of exchange.

Advantages of Money

Removes the coincidence of wants :

(a) Takes less storage space and is easier to carry.

(b) Liquidity of currency is easier

(c) Now-a-days; many instruments are available for money transaction so, one need not to carry physical currency.

MODERN FORMS OF MONEY

- Deposits with Banks: Generally we need only some currency for our daily needs. Rest of the amount is usually kept as deposit in banks. Money which is kept in a bank is safe and it even earns an interest. One can withdraw money from his account as and when required. Since, deposit in the bank account can be withdrawn on demand, these deposits are called demand deposits.

- One can use a cheque; instead of cash to settle payments. Moreover, one can also buy a demand draft from a bank to make payments.

- Credit: Banks keep a small proportion of their deposits as cash with themselves. This is usually 15% of their deposits as cash. This amount is kept as provision to pay the depositors who may come to withdraw the money on any day. This amount is enough because only a small fraction of people come to withdraw money on a given day.

- The rest of the amount is used by the banks to give money on credit to people who need the credit. A bank charges interest on the loan. The interest rate charged by a bank on loans is higher than the interest rate given by it on deposits. Thus, interest is the main source of income for banks.

- Credit/Debit Cards and Cellphone applications: Now-a-days, credit/debit cards are in vogue. A debit card allows you to make payments from the amount which is lying in your bank account. A credit card, on the other hand, provides money on credit. Payment through credit/debit card is done electronically and this removes the need of carrying cash.

- These days payments can be made and received through cell phone applications.

- This makes the transaction very convenient without carrying cash.

LOAN ACTIVITIES OF BANKS

- People often need to borrow money for various purposes. Many businessmen need to borrow to buy raw materials and machineries. Many farmers need to borrow to buy seeds, fertilisers, farm equipments, etc. People usually buy vehicles and houses by borrowing from banks. Thus, credit plays an important role in the economy.

- Every loan agreement specifies terms and conditions; regarding the rate of interest and terms of payment. In most of the cases, the banks fix an EMI (Equated Monthly Installment) for repayment of loan.

TWO DIFFERENT CREDIT SITUATIONS

A large number of transactions in our day-today activities involve credit or loan in some form. Loan refers to an agreement in which the lender gives the borrower money, goods or services in return for the promise of future payment.

Credit plays a vital and positive role business whether small or large. In business the loan is usually needed to finance the working capital. That is is to buy raw material and to pay for recurring expenses. The loan is usually paid after the finished goods are sold and payment are received.

In rural areas, the main demand for credit is for crop production. It involves considerable costs on seeds, fertilizers, pesticides, water, electricity, repair of equipment, etc. There is a minimum three to four months between the time when the farmers buy these inputs and when they sell the crop. Farmers usually take crop loans at the beginning of the season and repay the loan after harvest. Repayment of the loan is crucially dependent on the income from farming.

TERMS OF CREDIT

- Collateral: An asset which is owned by the borrower and is used as a guarantee to a lender until the loan is repaid is called the collateral. Land, house, vehicle, livestocks, deposits with banks, insurance policy, gold, etc., are examples of assets that can be kept as collateral. If the borrower fails to repay the loan, the lender reserves the right to sell the collateral to obtain payment.

- Documentation: The transaction between the lender and the borrower are put on record by documenting it. It includes rate of interest, tenure, collateral and mode of repayment. The terms of credit vary from one loan agreement to another and also on the nature of the lender and the borrower.

FORMAL SECTOR CREDIT IN INDIA

- The formal Sector comprises of banks and cooperative societies. The Reserve Bank of India supervises the functioning of formal sources of loans. For instance, we have seen that the banks maintain a minimum cash balance out of the deposits they receive. The RBI monitors that the banks actually maintain the cash balance.

- Similarly, the RBI sees that the banks give loans not just to profit-making businesses and traders but also to small cultivators, small scale industries, to small borrowers etc. Periodically, banks have to submit information to the RBI on how much they are lending, to whom, at what terms and conditions.

Informal Sector

- The informal sector consists of money lenders, traders, employers, friends, relatives, merchants and landlords. There is no organization which supervises the credit activities of lenders in the informal sector.

- They can lend at whatever interest rate and terms they wish.

- The informal lenders usually charge a very high rate of interest. A higher cost of borrowing is often detrimental to the borrower. It usually results in a debt trap for the borrower. The borrower is seldom able to escape the never ending cycle of loan repayment.

- Many people are too poor to qualify the requirements of credit-worthiness of banks and cooperatives. There are many others who may not have enough documents; like residential certificate or income certificate. Such people are usually at the mercy of informal lenders.

- Most loans from informal lenders carry a very high interest rate and have other stringent conditions. They do little to increase the income of the borrowers.

- Thus, it is necessary that banks and co-operatives increase their lending particularly in the rural areas, so that the dependence on informal sources of credit reduces.

- While formal sector loans need to expand, it is also necessary that everyone receives these loans. At present, it is the richer households who receive formal credit whereas the poor have to depend on the informal sources. ff It is important that the process and the requirements for availing formal credit should be made accommodative so that the poor can benefit from the cheaper loans.

SELF HELP GROUPS FOR THE POOR

- Self Help Groups (SHGs) are recent phenomena. A SHG is comprised of small number of people; like 15 – 20 members. The members pool their savings. The collection is then utilised to lend small amounts of money which may be required by any of the members. The group charges interest on the loan. The arrangement of loans through Self Help Groups is also known as microfinance because the small amount of loan is involved.

- It was the Grameen Bank of Bangladesh which began experimenting with microfinance. The founder of Grameen Bank, Mohammad Yunus was conferred with Nobel Prize in 2006 for his efforts at improving the lot of the poor.

- SHGs have helped immensely in reducing the influence of informal lenders in rural areas. Many big corporate houses are also promoting SHGs at many places in India.

Features

- Comprising 15-20 members

- Neighbors together save small amounts regularly

- Saving may vary from member to member

- Members can take small loans at low interest rates

- Collaterals are not required

- Repayment default is seriously followed by the members

Objectives

- To create a facility that will cater to the credit needs of the very poor section

- Targets small and marginal farmers and rural artisans

- It inculcates saving habit in the rural poor people

- To enhance participation

- To improve capabilities of women

- To enhance the socio-economic base of villages

- To encourage entrepreneurship in villages

Benefits

- Develops the habit of initiating action

- Improves living conditions

- Makes the members responsible for their actions

- Helps in capacity building

- Develops self confidence amongst members

- Promotes trust and mutual help

- Encourages resource pooling

- Leads to financial inclusion

“Microfinance recognizes that poor people are remarkable reservoirs of energy and knowledge. While the lack of financial services is not just a sign of poverty, today it is looked as an untapped opportunity to create markets, bring people in from the margins and give them the tools to help themselves” Kofi Annan (Ex. Sec General of UN) “The poor stay poor, not because they are lazy but because they have no access to capital” -Milton Friedman

Question : What do people belonging to poor households lack?

(a) Proper document

(b) Collateral

(c) Certificate of earning

(d) All of the above.

Answer : D

Question. A person can withdraw money from a bank by issuing a cheque. What is a cheque?

(a) Loan taken by the bank.

(b) Loan taken by the depositor from the bank.

(c) Paper instructing the bank to pay a specific amount.

(d) Paper valid to withdraw money

Answer : C

Question. Which of the following is not a feature of Self Help Groups (SHGs)?

(a) It consists of 15-20 members or more.

(b) Here members pool their savings which acts as collateral.

(c) Loans are given at nominal rate of interest.

(d) It is an informal source of credit.

Answer : D

Question. Which one of the following is not a formal source of credit?

(a) Commercial Banks

(b) State Bank of India

(c) Employers

(d) Co-operatives

Answer : C

Question. What is the main source of income of a bank?

(a) Bank charges that the depositors pay for; keeping their money safe is the main ; source of the bank’s income.

(b) The difference between what is charged from the borrowers and paid to the depositors is the main source of bank’s income.

(c) Banks earn huge amounts of money by investing the money of the depositors in various company shares.

(d) The Government of India gives huge amounts of money to the banks to help their smooth functioning.

Answer : B

Question. All the banks actas mediator between-------------and----------

(a) rural people, urban people

(b) literates, illiterates

(c) people, government

(d) depositors, borrowers

Answer : D

Question. All the banks act asmediator betweenand ……........... .

(a) rural people, urban people

(b) literates, illiterates

(c) people, government

(d) depositors, borrowers

Answer : D

Question. Organised credit is also called

a. informal credit

b. formal credit

c. cooperative credit

d. none of these

Answer : B

(b) exchange system

(d) no-money system

(b) coin

(d) demand deposit

(b) formal credit

(d) none of these

(b) SBI

(d) all of these

Question : Modern form of money is linked with which system?

(a) Accounts system

(b) Finance system

(c) Banking system

(d) None of the above.

Answer : C

Question : What portions of bank deposits are kept by the banks for day to day transactions?

(a) 11% of the deposits

(b) 15% of the deposits

(c) 18% of the deposits

(d) 17% of the deposits.

Answer : B

Question : Which one of the following does not come under terms of credit?

(a) Interest rate

(b) Employment

(c) Collateral

(d) Mode of repayment.

Answer : B

Question : Formal sources of credit does not include

(a) Banks

(b) Cooperatives

(c) Employers

Answer :C

Question : What are electronic banking services?

(a) ATM

(b) Debit Card

(c) Credit Card

(d) All of the above.

Answer : D

Question : Currency notes in India are issued by the ...... .

(a) State Bank of India

(b) Reserve Bank of India

(c) Central Bank of India

(d) None of the above.

Answer : B

(b) method of payment

(d) none of these

(b) workers

(d) all of these

Fill In The Blank

Question : _____ issues currency notes on behalf of the Central Government.

Answer : Reserve Bank of India

Question : Majority of the credit needs of the _____ households are met from informal sources.

Answer : poor

Question : _____ is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer : Collateral

True/False

Assertion And Reason

CASE STUDY Questions:

1. Ramu is a potter making pots, wants to exchange pots for wheat.

Luckily, he meets a farmer who has wheat and is willing to exchange it for the pots. What is this situation known as?

i. Incidence of wants

ii. Double coincidence of wants

iii. Barter system of wants

iv. None of the above

Answer : B

2. Sam is a merchant. He has some surplus money, he opens a bank account and deposits in it. Whenever he needs money, he can go to his bank and withdraw from there. This kind of deposit with the banks are known as:

(a) demand deposit

(b) term deposit

(c) fixed deposit

(d) surplus deposit

Answer : A

3. Thomas and Selvan are small farmers. Thomas has taken credit @ 1.5% per month on < 20000 from a trader while Selvan has taken credit at 8% per annum from bank on the same amount. Who is better off?

(a) Thomas is better because he has to do no paperwork.

(b) Selvan is better because his interest payment is less.

(c) Thomas is better because he has not paid any collateral.

(d) Both Thomas and Selvan are equal so no one is better off.

Answer : B

4. Nakul is a trader. He provides farm inputs on credit on the condition

that farmers will sell their crop products to him atprices so thathe could sell them at-------------prices in the market.

(a) high, medium

(b) low, high

(c) medium, high

(d) high, low

Answer : B

Very Short Answer Type Questions

Question : What do people do with extra money?

Answer : They deposit it with the banks by opening a bank account in their name.

Question : Why do we consider demand deposits as money?

Answer : Demand deposit constitute money in modern economy as they are accepted widely as a means of payment along with currency.

Question : What does higher cost of borrowing means?

Answer : This means a large part of the earnings of the borrowers is used to repay the loan. Hence, borrowers have less income left for themselves.

Question : When is crucial for the country’s development?

Answer : Cheap and affordable credit is crucial for the country is development.

Question : How do the SHGs help borrowers?

Answer : The SHGs help borrowers overcome the problem of lack of collateral.

Question : What is a cheque?

Answer : A cheque is a paper instructing the bank to pay a specific amount from a person’s account to the person in whose name the cheque has been issued.

Question : Why are banks unwilling to lend loans to small farmers?

Answer : Banks provide loans after collateral and documentation securities, which generally the small farmers fail to comply with. Therefore, banks are unwilling to give loans to small farmers.

Question : Who supervises the functioning of formal sources of loans?

Answer : Reserve Bank of India

Question : Prove with an argument that there is a great need to expand formal sources of credit in rural India.

Answer : There is a great need to expand the formal sources of credit in rural India because:

• There is no organisation to supervise credit activities of the informal sector. It could lead to increasing debt among the borrowers.

• The rate of interest is very high in informal sector.

Question : What are the two forms of modern currency?

Answer : Paper notes and Coins

Question : What is a debt-trap?

Answer : A debt-trap is a situation when it becomes impossible to repay the loan and the borrower adds on a new debt to pay the existing debt.

Question : Compare formal sector loans with informal sector loans regarding interest only.

Answer : In formal sector, the rate of interest is low. It is fixed by the Reserve Bank of India, who supervises the functioning of formal sources of loan.

In informal sector, the rate of interest is very high as there is no organisation to supervise the functioning of informal sources of loan.

Question : What is the meaning of barter system?

Answer : A system where goods are directly exchanged without the use of money is called barter system.

Question : How do the deposits with the banks become their source of income?

Answer : Banks use a major portion of deposits to extend loans. They charge a higher rate of interest on loans than what they offer on deposits. The difference between what is charged from borrowers and what is paid to the depositors is the main source of income for the banks.

Question : Why are most of the poor households deprived from the formal sector of loans?

Answer : Most of the poor households are deprived from the formal sector of loans because they do not have the collateral to keep with the banks.

Short Answer Type Questions

Question. Why do banks ask for collateral while giving credit to a borrower?

Answer : Collateral is an asset that the borrower owns such as land, building, vehicle, livestock, land documents, deposits with banks etc. This stands as a security against the money borrowed from the bank. In case the borrower fails to repay the loan to the bank, the lender has the right to sell the asset or collateral.

Question. What comprises ‘terms of credit’?

Answer : Rate of interest, collateral security, documentation requirements and mode of repayment together comprise terms of credit. This varies from bank to bank and borrower to borrower.

Question. “Supervision of the functioning of formal sources of loans is necessary”.

Answer : Supervision of the functioning of formal sources of loans is necessary because banks have to submit information to the RBI on how much they are lending, to whom they are lending and at what interest rate etc.

Question. “There is a great need to expand formal sources of credit in rural India.”

Examine the statement.

Answer : There is great need to expand formal sources of credit in rural India because: In the informal sector there is no organisation to supervises the credit activities of lenders. They lend at whatever interest rate they choose. No one can stop rural money-lenders from using unfair means to get their money back.

Question : Why are the deposits in the banks called ‘demand deposits’? What are the benefits of deposits with the banks?

Answer : People deposit extra cash with the bank by opening a bank account in their name. Banks accept the deposits and also pay an amount as interest on the deposits. In this way people’s money is safe with the banks and it earns an amount of interest. People also have the provision to withdraw the money as and when they require. Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits.

Question : What are the difficulties from which the barter system of exchange suffers?

Answer : (i) Lack of double coincidence of wants.

(ii) Valuations of all the goods cannot be done easily.

(iii) Certain products cannot be divided.

Question : What does credit mean? What are the terms of the credit?

Answer : Credit refers to an agreement in which lender supplies the borrowers with money, goods and services in return for the promise of future payments.

Terms of credit includes the following:

(i) Interest rate

(ii) Collateral

(iii) Documentation requirement

(iv) Mode of payment.

These terms of credit vary substantially from one credit arrangement to another. They may vary depending on the nature of lender and borrower. Every loan agreement specifies an interest rate which the borrower has to pay to the lender along with the repayment of the principal. In addition to this lenders maydemand collateral (security) against the loans.

Question : Why is the rupee widely accepted as a medium of exchange?

Answer : (i) In India, the Reserve Bank of India issues currency notes on behalf of the central government.

(ii) As per Indian law, no other individual or organisation is allowed to issue currency.

(iii) Moreover, the law legalises the use of rupee as a medium of payment that cannot be refused in settling transaction in India.

(iv) No individual in India can legally refuse a payment made in rupees. Hence, the rupee is widely accepted as a medium of exchange.

Long Answer Type Questions

Question. How do SHG’s act to provide a platform for women to address their various social issues?

Answer : SHGs act to provide a platform for women to address their various social issues in the following ways:

(1) A Self-Help Group is an organization of rural poor, particularly women who pool their savings.

(2) The SHG encourages its members for savings and enables them to take small loans from the group itself to meet their needs. In this way, it addresses their economic issue that is the base of many social issues.

(3) SHGs are the building blocks of the organization of the rural poor. Not only does it help women to become financially self-reliant, but the regular meetings of the group also provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

(4) The SHG provides self-employment opportunities to its members by providing them loans for meeting working capital needs, for housing materials, for acquiring assets like a sewing machine, handlooms, cattle, etc.

(5) The group charges interest on these loans but this is still less than what the money-lenders charge.

Question. Self-Help Groups enjoy a lot of freedom in their functioning. Explain.

Answer : (1) In Self-Help Groups, there is no provision of a certain number of members or a certain amount to deposit. Members are free to their number andamount to deposit in the group.

(3) Most of the important decision regarding the savings and loan activities are taken by the group members.The group decides as regards the loans to be granted—the purpose, amount, interest to be charged, repayment schedule, etc.

(4) Also, it is the group which is responsible for the repayment of the loan. In any case of non-repayment of the loan by anyone, the member is followed up seriously by other members in the group.

(5) The SHGs help borrowers overcome the problem of lack of collateral and documentation requirement. Besides, the regular meetings of the group provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

Question : Why are banks necessary for a country?

Answer : Banks provide 'Yeoman Services" to the country. The modernisation of any economy has been possible with the development of banking system of that country. Following are the reasons which justify the necessity of banks for a country:

(i) Banks mobilise the dormant savings of the country. The surplus money which the people have and don't need in the near future is accepted by the banks as deposits.

(ii) These deposits of the public provide safety to their funds and income in the form of interest.

(iii) People can withdraw this money whenever they are in need. So, these deposits provide liquidity to the depositors.

(iv) Banks provide loans to the needy borrowers.

(v) Banks provide loans to the people out of the money deposited by the depositors. In this way the banks acts the role of financial intermediary.

(vi) Most of the credit issued by the banks is used for productive purposes which increase the production and employment opportunities in the economy.

(vii) Banks provide credit facilities not only to general people, but they also participate in providing government loans as well. So, in this way, banks help the government in the

development of infrastructural facilities.

Question : In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

OR

How does Reserve Bank of India play a crucial role in controlling the formal sector loans. Explain.

Answer : Reserve Bank of India (RBI) supervises the functioning of the banks in the following manner:

(i) First of all, RBI determines the necessary reserve ratios for banks such as Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) to be maintained by them. The reserves are maintained by the banks to deal with the liquidity crunch in case if it arises. These reserves are calculated on the basis of the deposits held with the banks.

(ii) The banks have to periodically submit report to the RBI regarding the credit portfolio. They have to ensure that they do not breach any of the instructions given by RBI on the management of credit portfolio. This helps the RBI to contain any risk situations that may emerge due the lending practices of thebanks.

(iii) RBI also ensures that the banks are not being partial in providing loans. It means that RBI ensures that the banks are lending not only to the big businessmen or companies, but also taking care of the weaker sections of the society like small farmers and agricultural labourers in rural areas and small businessmen, labourers, small artisans etc. in urban areas. Lending to such weaker sections may be included in priority sector lending of the banks.

(iv) The RBI may supervise the expansion pattern of the banks in order to ensure that the banks are not only opening their branches in urban areas, but also expanding their facilities in rural and remote areas like hilly areas of the country.

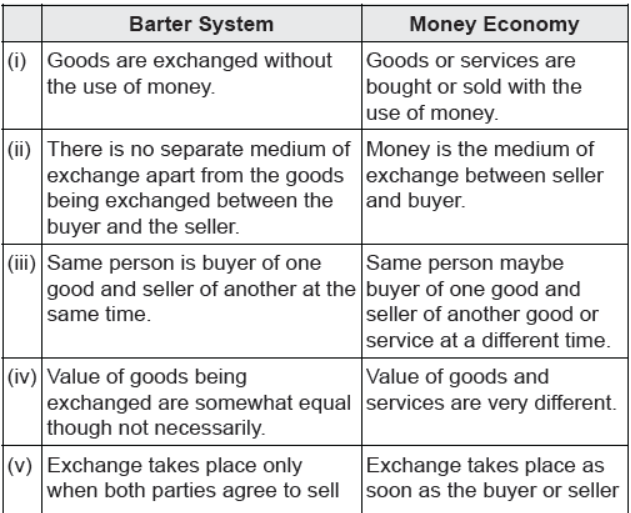

Question : Differentiate between Barter System and Money Economy.

Answer :

Question : What are the merits and demerits of credit ?

OR

‘‘Credit is useful as well as harmful, it depends on the risk involved.’’ Support the statement with examples.

Answer : Credit is a facility in which a lender extends a loan to a borrower to fulfill his needs with a promise from the borrower to return the borrowed money to the lender with predetermined interest. Such credit may be in terms ofmoney as well as goods and services. The credit facility has following merits and demerits :

Merits :

(i) It provides much needed purchasing power to the borrower which he lacks.

(ii) It helps the borrower to mobilise the productive resources.

(iii) It helps to increase the production of the borrower and the country.

(iv) It helps to raise the income and standard of living of the borrower.

(v) It helps the lender to earn income in the form of interest.

(vi) It helps to utilise surplus money of lender which is not in immediate use.

Demerits :

(i) It puts a burden of payment of excess amount on the borrower. The excess amount refers to the sum of principal and interest.

(ii) It puts the borrower in stress of losing an asset or reputation if he fails to return the borrowed money on time.

(iii) If the borrower looses the loan amount and is not supported by the financial or asset backup, he may fall into the debt trap.

(iv) If the terms of credit are unfavourable, the borrower may face difficulties in carrying on with the credit.

Credit is helpful in a situation where there is not much risk. For Example : Mohan take a loan to complete an order for shoe delivery. Since the order is already placed, taking the loan

does not involve much risk. Hence, Mohan is able to take benefit from the loan. But Neelima takes the loan for crop cultivation. This is risky as the crop may fail due to pests. This

indeed happens and Neelima cannot repay the loan. She takes another loan next year and get caught in a debt trap.

Source / Case Based Questions

Question : Read the extract given below and answer the questions that follow:

Besides banks, the other major source of cheap credit in rural areas are the cooperative societies (or cooperatives). Members of a cooperative pool their resources for cooperation in certain areas. There are several types of cooperatives possible such as farmers cooperatives, weavers' cooperatives, industrial workers cooperatives, etc. Krishak Cooperative functions in a village not very far away from Sonpur. It has 2300 farmers as members. It accepts deposits from its members. With these deposits as collateral, the Cooperative has obtained a large loan from the bank. These funds are used to provide loans to members. Once these loans are repaid, another round of lending can take place. Krishak Cooperative provides loans for the purchase of agricultural implements, loans for cultivation and agricultural trade, fishery loans, loans for construction of houses and for a variety of other expenses.

Answer the following MCQs by choosing the most appropriate option:

(i) The passage given above relates to which of the following options?

(a) Loan condition in rural areas

(b) Loans from cooperatives

(c) Procedure to obtain loan

(d) Various sources of credits

Answer : (b) Loans from cooperatives

(ii) According to the given passage, Krishak cooperative is a good example of cooperative source of credit based on which of the following options?

(a) Provides cheap loan

(b) Functions in village setup

(c) Easy collateral

(d) Its members are local farmers and they pool their funds

Answer : (d) Its members are the local farmers and they pool their funds

(iii) By providing loans to the small farmers, krishak Cooperative wants to:

(a) increase the income of the farmers.

(b) protect them from moneylenders.

(c) provide them cheap credit.

(d) all of the above

Answer : (d) all of the above

(iv) In a rural setup, cooperative societies are highly effective mode of credit because:

(a) they have a large number of members.

(b) they do not need collateral.

(c) they provide loans at easy terms with low interest.

(d) they directly purchase agricultural equipments for farmers.

Answer : (c) they provide loans at easy terms with low interest.

Question : Credit is one of the major aspects that determine a country's development. There is a huge demand for loans for various economic activities. Cheap and affordable loans give people an opportunity to develop their business. Credit plays a very crucial role in agricultural activities. People can borrow money and use it to adopt modern farming methods to increase the crop production and grow crops which are more reliable than the traditional methods. By sanctioning loans to developing industries and trade, banks provide them with the necessary aid for improvement. This leads to increased production, employment and profits that ultimately help in the development of the country.

(i) What is main aspect that determines the country’s development?

(a) Economic activities

(b) Agricultural activities

(c) Credit

(d) None of the above

Answer : (c) Credit

(ii) Which one of the following is not included in the terms of credit?

(a) Rate of Interest

(b) Mode of payment

(c) Rate of saving

(d) Collateral

Answer : (c) Rate of saving

(iii) ‘Cheap and affordable loans give people an opportunity to develop their business’. Identify whether this statement is true or false.

(a) False

(b) True

(c) Inadequate information

(d) None of the above

Answer : (b) True

(iv) Fill up the blank: People can borrow money and use it to adopt __________ farming methods to increase the crop production and grow crops.

(a) modern

(b) traditional

(c) advanced

(d) none of these

Answer : (a) modern

(v) Two statements are given in the question below as Assertion and Reasoning. Read the statements and choose the appropriate option.

Assertion : Bank loans leads to increased production, employment and profits that ultimately help in the development of the country

Reason : Credit plays a very crucial role in procurement activities.

Options:

(a) Both A and R are true but R is the correct explanation of A.

(b) Both A and R are true but R is not the correct explanation of A.

(c) A is true and R is false.

(d) A is false but R is true.

Answer : (c) A is true and R is false

Points to remember for Understanding Economic Development Chapter 03 Money and Credit

Money as a Medium of Exchange

Money is used for several transactions. It is considered as a means of exchange, as it acts as intermediate in the exchange process.

Barter System of Exchange

Before the use of money, people followed barter system of exchange. In this system, goods are directly exchanged (without use of money) between two or more people who agree to exchange each other’s goods.

For example, farmer exchanging wheat for shoes and vice versa.

In this case, the farmer and shoes manufacturer should be in need of each other’s goods. This is called double coincidence of wants. The major drawback of this system was the lack of double coincidence of wants, as without it, exchange was not possible. The use of money eliminated the need of double coincidence of wants. Money was accepted as a common medium of exchange.

Modern Forms of Money

Modern forms of money include currency (paper notes and coins). Before the introduction of coins, a variety of objects like grains and cattle were used as money. Further, the use of metallic coins of gold, silver, copper, etc started.

Currency

It is a generally accepted form of money, that includes coins and paper notes. It is authorised by the government and circulated within an economy. The modern currency has no use of its own except as a medium of exchange.

In India, Reserve Bank of India can only issue currency notes on behalf of the Government of India. The rupee is widely accepted as a medium of exchange as it is legalised by law.

Deposits with Banks

It means the amount that people keep in their bank accounts. People deposit their extra money in banks by opening a bank account in their name. The money in bank account are deposits with banks. Banks accept the deposits and also pay an interest on the deposits. People can also withdraw the money when they require. Deposit with banks are called Demand Deposits.

Cheque Facility

Cheque is basically a paper instructing the bank to pay a specific amount from the person’s account to that person in whose name the cheque has been issued. Payments can be made with the use of cheque instead of cash.

Modern Banking System

The modern forms of money i.e. currency and deposits are closely linked to the working of the modern banking system.

Loan Activities of Banks

Banks accept deposits of the people. In this way, they collect large amount as deposits. They keep only a small portion of deposits (in India, it is 15%) as cash.

This is kept for those depositors who wish to withdraw money from their accounts. Rest of the deposits are given as loans by the banks.

When banks give loans, they charge higher rate of interest from the people who have taken loans. This becomes the income of the banks. In this way, banks act as mediator between those who have surplus funds (the depositors) and those who are in need of funds (the borrowers).

Credit

Credit or loan refers to an agreement in which the lender supplies money, goods or services to borrower with the promise of future payment. A large number of transactions in our day-to-day activities involve credit in some form or the other.

Two Different Credit Situations

(i) In the first situation, credit is used to meet the production expenses. When the production is complete then it increases earnings. Here, credit plays a positive role.

For example, Salim a manufacturer takes credit for his business. During the festival season, he receive large orders from traders. To complete production on time, he ask the raw material suppliers to supply material on credit.

He also obtains loan in cash from the trader as some of the advance payment for the goods to be supplied.

At the end of the manufacturing cycle, Salim is able to deliver the order, make a good profit and repay the money that he had borrowed. This helps to increase earnings and therefore, the person is better off than before.

(ii) In the second situation, credit pushes the borrower into a situation from which recovery is very difficult and painful.

For example, Swapna takes loan from moneylender to grow groundnut, hoping that her harvest would help repay the loan. Midway through the season the crop is hit by pests and the crop fails. She is unable to repay the moneylender and the debt grows over the year into a large amount.

Next year, Swapna takes a fresh loan for cultivation. It is a normal crop this year but the earnings are not enough to cover the old loan. She is caught in debt. She has to sell a part of the land to pay off the debt.

In this situation, credit pushes Swapna into a debt-trap. Her condition becomes worse than before.

Interpretation of Both Situations

• From both the examples, we see that in one situation credit helps to increase earnings and therefore, the condition of a person is better than before.

• In other situation, because of the crop failure credit pushes the person into a debt-trap. Whether credit would be useful or not, it depends on the risks in the situation and whether there is some support, in case of loss.

Terms of Credit

It is a set of conditions under which a loan is given. It may include method of payment, rate of interest, duration of credit and other related conditions like, collateral, documentation requirement6 and the mode of repayment.

The terms of credit may vary according to the situation of the lender and the borrower.

Collateral

It is a security against loans. It is an asset that the borrower owns and uses this as a guarantee to a lender until the loan is repaid. If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

Some examples of collateral security used for borrowing are land titles, deposits with banks, livestock, etc.

Variety of Credit Arrangements

There may be different credit arrangements for different categories of borrowers. These are

• Loan from Moneylenders Small farmers borrow money from the village moneylender at high rate of interest. Due to high interest rate they fell in debt-trap.

• Loan from Traders Farmers get loans from agricultural traders at a lower rate of interest. But the traders also get the promise of the farmers to sell their crops to him only. In this way, trader ensures that the money is repaid besides making profit. He buys crop from farmers at low price and sell it later, when price is high.

• Loan from Banks Some farmers take loan for cultivation from banks, at very low interest rate and at easy repayment terms.

Banks also provide other facilities to such borrowers.

• Loan from Employers Landless agricultural labourers and workers depend on their employers for loan. The landowner may charge interest rate upto 5% per month. The workers work for landowners in order to repay the loan.

• Loan from Cooperatives This is the major source of cheap credit in rural areas. Loans to member of cooperative societies can be provided for the purchase of agricultural implements, cultivation and agricultural trade, fisheries, construction of houses and other expenses.

Credit Sources in India

The two categories of sources of credit are formal sector credit or loans and informal sector credit or loans.

The formal sector comprises banks and cooperative societies. The informal sector may consist of moneylenders, friends and relatives, traders, landowners, large farmers, etc.

Features of Formal Sector Credit

• It provides loans comparatively at a lower rate of interest and collateral security is required to obtain loans.

• This sector is mainly supervised by the RBI (Reserve Bank of India).

• It includes banks and cooperatives.

Role of RBI in Formal Sector

RBI has major role in providing formal sector credit. Its role is

• The RBI (Reserve Bank of India) ensures that the banks give loans not just to profit-making businesses and traders, but also to small cultivators, small scale industries, small borrowers, etc.

• Periodically, banks have to submit information to the RBI on how much they are lending, to whom and at what interest rate they are lending to borrowers, etc.

• The banks maintain a minimum cash balance out of the deposits they receive. The RBI monitors the banks in actually maintaining cash balance.

Features of Informal Sector Credit

• This sector charges higher interest rates on the loans that are given as there is no organisation to supervise this sector.

• This sector could lead to increasing debt as the borrower finds difficulty in paying back.

• People who might wish to start an enterprise by borrowing from the informal sector may not do so because of the high cost of borrowing. However, still poor households in urban and rural areas depend upon informal sources for their borrowing needs as they don’t require any collateral.

Self Help Groups (SHGs) for the Poor

Self Help Group is a group of people usually belonging to one neighbourhood having same social and economic backgrounds. They meet and save money regularly as per their ability.

Members of the group (usually 15-20) can take small loans from the group itself to meet their needs. The group charges interest less than moneylenders on these loans.

After one or two years, if the group is regular in savings, it becomes eligible for availing loan from the bank. Loan is sanctioned in the name of group and is meant to create self-employment opportunities by providing money to buy raw materials, seeds, assets like sewing machines, handlooms, cattle, etc.

SHGs : A Helping Hand for Women

SHGs are the building blocks of organisation of the rural poor. The SHGs help women to become financially self-reliant and regular meetings of the group provide a platform for women to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

Grameen Bank of Bangladesh

Professor Muhammad Yunus, the founder of Grameen Bank and recipient of 2006 Nobel Prize for Peace, started the bank as a small project in the 1970s. He provided small credit on reasonable terms and conditions to millions of poor people with different occupations.

| CBSE Class 10 Geography Resources And Development Worksheet Set A |

| CBSE Class 10 Geography Resources And Development Worksheet Set B |

| CBSE Class 10 Geography Resources And Development Worksheet Set C |

| CBSE Class 10 Geography Forest And Wildlife Resources Worksheet Set A |

| CBSE Class 10 Geography Forest And Wildlife Resources Worksheet Set B |

| CBSE Class 10 Geography Forest And Wildlife Resources Worksheet Set C |

| CBSE Class 10 Geography Water Resources Worksheet Set A |

| CBSE Class 10 Geography Water Resources Worksheet Set B |

| CBSE Class 10 Geography Agriculture Worksheet |

| CBSE Class 10 Political Science Power Sharing Worksheet |

| CBSE Class 10 Social Science Power Sharing Worksheet Set A |

| CBSE Class 10 Social Science Power Sharing Worksheet Set B |

| CBSE Class 10 Civics Federalism Worksheet |

| CBSE Class 10 Political Science Federalism Worksheet |

| CBSE Class 10 Social Science Federalism Worksheet |

| CBSE Class 10 Political Science Democracy And Diversity Worksheet |

| CBSE Class 10 Social Science Democracy Diversity Worksheet |

| CBSE Class 10 Political Science Gender Religion And Caste Worksheet |

| CBSE Class 10 Social Science Gender Religion And Caste Worksheet |

| CBSE Class 10 Political Science Popular Struggles And Movements Worksheet |

| CBSE Class 10 Social Science Popular Struggles And Movements Worksheet |

| CBSE Class 10 Political Science Political Parties Worksheet |

| CBSE Class 10 Social Science Political Parties Worksheet |

| CBSE Class 10 Political Science Outcomes Of Democracy Worksheet |

| CBSE Class 10 Political Science Challenges To Democracy Worksheet |

| CBSE Class 10 Social Science Challenges to Democracy Worksheet |

| CBSE Class 10 Social Science History The Rise Of Nationalism In Europe Worksheet |

| CBSE Class 10 Social Science The Rise Of Nationalism In Europe Worksheet |

| CBSE Class 10 History Nationalism In India Worksheet |

| CBSE Class 10 History Nationalist Movement In India One Mark Questions |

| CBSE Class 10 Social Science Nationalism in India Worksheet |

| CBSE Class 10 Social Science Nationalism in India Worksheet |

| CBSE Class 10 Social Science The Making of a Global World Worksheet |

| CBSE Class 10 Social Science The Age of Industrialisation Worksheet |

| CBSE Class 10 Social Science Print Culture Modern World Worksheet |

| CBSE Class 10 Social Science Development Worksheet Set A |

| CBSE Class 10 Social Science Development Worksheet Set B |

| CBSE Class 10 Economics Sectors Of Indian Economy Worksheet Set A |

| CBSE Class 10 Economics Sectors Of Indian Economy Worksheet Set B |

| CBSE Class 10 Social Science Sectors Of Indian Economy Worksheet |

| CBSE Class 10 Economics Money And Credit Worksheet |

| CBSE Class 10 Social Science Money And Credit Worksheet |

| CBSE Class 10 Social Science Globalisation and the Indian Economy Worksheet |

| CBSE Class 10 Social Science Globalization Worksheet |

| CBSE Class 10 Economics Consumer Awareness Worksheet |

Worksheet for CBSE Social Science Class 10 Chapter 3 Money and Credit

We hope students liked the above worksheet for Chapter 3 Money and Credit designed as per the latest syllabus for Class 10 Social Science released by CBSE. Students of Class 10 should download in Pdf format and practice the questions and solutions given in the above worksheet for Class 10 Social Science on a daily basis. All the latest worksheets with answers have been developed for Social Science by referring to the most important and regularly asked topics that the students should learn and practice to get better scores in their class tests and examinations. Expert teachers of studiestoday have referred to the NCERT book for Class 10 Social Science to develop the Social Science Class 10 worksheet. After solving the questions given in the worksheet which have been developed as per the latest course books also refer to the NCERT solutions for Class 10 Social Science designed by our teachers. We have also provided a lot of MCQ questions for Class 10 Social Science in the worksheet so that you can solve questions relating to all topics given in each chapter.

You can download the CBSE Printable worksheets for Class 10 Social Science Chapter 3 Money and Credit for latest session from StudiesToday.com

There is no charge for the Printable worksheets for Class 10 CBSE Social Science Chapter 3 Money and Credit you can download everything free

Yes, studiestoday.com provides all latest NCERT Chapter 3 Money and Credit Class 10 Social Science test sheets with answers based on the latest books for the current academic session

CBSE Class 10 Social Science Chapter 3 Money and Credit worksheets cover all topics as per the latest syllabus for current academic year.

Regular practice with Class 10 Social Science worksheets can help you understand all concepts better, you can identify weak areas, and improve your speed and accuracy.