SESSION 3: TYPES OF PRICING

Firms, in a competitive market aim at profit maximization and long term growth. For devising a unique pricing policy for their product they have to methodically analyse the market situations.

Generally pricing can be put into following four categories-

• Demand-oriented pricing

• Cost-oriented pricing

• Competition-oriented pricing or market driven pricing

• Value- based pricing

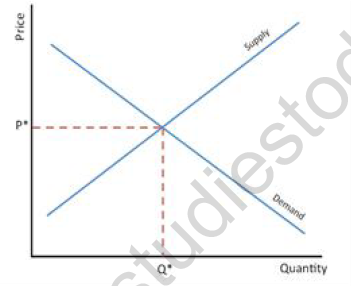

Demand-oriented pricing: When customer demand sets up the price of a product in the market, it is called Demand oriented pricing. There is an inverse relationship between the price and quantity demanded of a commodity. Higher is the price of a product, lower will be its demand and lower is the price of a product, higher will be its demand in a market. The basic equilibrium price is determined by the forces of demand and supply. It is fixed at the level where quantity demanded and quantity supplied is equal.

If demand of a commodity increases with respect to previous supply, its price increases, and if supply of a commodity increases with respect to previous demand, its price falls. It is termed as price elasticity of demand, which is the core of product pricing. On the other hand necessity goods have inelastic demand as any change in price does not affect their demand, e.g. demand for bread, rice, milk or vegetables does not fall due to increased price. Advantage of demand oriented pricing to a firm is that it increases firm’s ability to optimize prices using diagrams that predict ideal prices.

COST-ORIENTED PRICING:

A method of setting prices that takes into account the company's profit objectives and covers its costs of production is called Cost-oriented pricing. In this the marketer mainly takes production costs as the key factor for determining the initial price, but normally overlooks the target market’s demand for that product. This pricing again is of three types-

• Cost plus Pricing

• Markup Pricing

• Break-even Pricing

(a) Cost plus Pricing: Cost plus pricing is a cost-based method for setting the prices of goods and services. This type of pricing is most common type of product pricing. In this approach the cost estimates of a product is made and margin of profit is added to determine the price. The formula for its calculation is-Selling Price = Unit total cost + Desired unit profit Cost plus pricing is advantageous as it tells firm what prices competitors are charging in the market, but it ignores replacement costs issue.

(b) Markup Pricing: Markup is the difference between the cost of a good or service and its selling price. This pricing policy is generally adopted by the resellers who obtain the product from producers or whole sellers use a percentage increase on the top of product cost to arrive at an initial price. Retailers apply a set percentage for each product category according to their marketing objectives. For example at the time of annual sale firms adopt mark-up pricing on their products. The advantage of mark-up pricing is that this method helps firms fight the inflation effects throughout periods of increasing cost. With this firms can pass on increased production costs to its customers and generate a profit. But when firms feature prices too high or extremely low then these miss opportunities in terms of profit.

(c) Break-even Pricing: Break even pricing is the practice of setting a price point at which a business will earn zero profits on a sale. The cost of production is composed of fixed cost of production and variable cost of production. Fixed cost arises on fixed factors of production, which do not change during short run. Variable cost of production arises on variable factors of production, and increase with increased volume of production. Break even analysis uses market demand as a basis of price determination. The formula for its calculation is-

BEP = Total Fixed Cost / Selling Price per unit – Variable cost per unit The equilibrium establishes at a point where total revenue is equal to total cost and the firm enters into ‘Break-even’; a situation of ‘no profit, no loss’.

C. COMPETITION-ORIENTED PRICING OR MARKET DRIVEN PRICINGCompetitive pricing is setting the price of a product or service based on what other firms are charging. This type of pricing generally takes place in perfect competitive market situation.Here product is homogeneous and buyers and sellers are well informed about market price and market conditions. The seller has no control on price and has to accept this customary or market driven price. He cannot increase price rather has to adjust his cost to this customary price by reducing the quantity of the product. For example, Airtel initially kept high prices for its mobile services, but by entry of Vodafone, Idea and reliance Jio the prices for various mobile services have been slashed. The advantage of competitive pricing is that it avoids price competition that can damage the company, but disadvantage is that this pricing method may only cover production costs, resulting in low profits to the firm.

VALUE- BASED PRICING:

Value-based price is a pricing strategy which sets prices primarily, according to the perceived or estimated value of a product or service to customer rather than according to the cost of the product. In this type of pricing price of a product is determined on customers’ perception of value rather than the seller’s cost. Pricing begins with analysis of consumers’ needs and value perceptions and then company sets its target price and designs the product. It is quite opposite to cost based pricing as higher value of product is perceived due to company’s brand image or marketing at prestigious retail outlets. For example, the products sold at ‘Fab-India’ or ‘Forest Essentials’ cosmetics are considered as premium products by the customers and so are priced high.

A Value-based pricing strategy can be advantageous because it goes inside the mind of the intended consumer to predict what the consumer would be willing to pay for a product and so helps firm in setting price.

Major Pricing Methods:

It is very difficult to ascertain precisely which pricing policy a firm practices because mostly, a firm uses a combination of different policies at once. It is also because not all the policies may be in explicit form.

The major pricing policies followed by business enterprises are discussed below:

• Competitive Pricing

• Penetration Pricing

• One Price versus Variable Pricing

• Market Skimming Pricing

• Discrimination or Dual Pricing

• Premium Pricing

• Leader Pricing

• Psychological Pricing

• Price Lining

• Resale Price Maintenance

• Everyday low pricing

• Team pricing

(a) Competitive Pricing: In this, the management of a firm fixes the price at the competitive level in certain situations. This method is used when the market is highly competitive and the product is not differentiated significantly with respect to competing products. For example, when Coca-Cola introduced the 200ml beverage bottles for ₹8 only, rival Pepsi followed suit to tackle the competition.

(b) Penetration Pricing: Under this pricing method, the company’s objective is to penetrate the market; capture a large market share and develop popularity of the brand. For this purpose, prices are fixed below the competitive level. This method of pricing is usually found at the retail level of distribution, for products with a highly elastic demand. For example, the makers of Nirma detergent powder used penetration pricing to enter the market and raise its market share quickly at the cost of Surf.

(c) One Price versus Variable Price Policy: In case of one-price policy, the seller charges the same price to similar types of customers who purchase similar quantities of the product under the same terms of sale. The price may vary according to the quantity of purchase. For example, a seller may charge ₹10 per unit if less than one dozen units are purchased, and at ₹9 per unit if more than one dozen units are purchased.

In case of variable-price policy, the seller sells similar quantities to similar buyers at different prices. For example, a seller may sell the same product at a lower price to old or loyal customers. It usually happens for products such as refrigerators, automobiles, TVs etc.

(d) Market Skimming Pricing: Under this pricing method, a seller may charge higher prices during the initial stages of the product life- that is, during the introduction of the new product in market. This is done to recover the initial investment on the product quickly and reap higher profits during the introduction stage, because of fear of competition at a later stage in the product-life-cycle, e.g. Apple’s iphone-7 is highly priced in the market.

(e) Discrimination or Dual Pricing: Under this pricing method, a firm will charge different prices from different customers according to their ability to pay. This policy is popular with service-enterprises like legal and medical services, CAs, etc.

(f) Premium or Prestige Pricing: A company that sells a premium product, ie a product of supreme quality and unique features and technology will employ premium distribution channels and promotional strategies. To justify these, the

pricing of such a product is also premium. Premium pricing can give rich dividend when buyers are not price-conscious and are willing to pay a higher price for a better product, e.g. consumers are ready to pay high price for Van Huesen shirts in comparison of local brands.

(g) Leader Pricing: Under this method of pricing, the prices of one or a few items may be cut temporarily to attract customers. Such products are called “loss leaders”. Loss-leader products are mostly popular, highly advertised and purchased products. The rationale behind this method is that customers will come to the store to buy the advertised loss-leader product and then stay to buy other regular-priced products of the same company, leading to increased volume of sales.

(h) Psychological Pricing: Under this pricing method, the prices of products are set in such a way that has a psychological influence on the buyers. Customary Pricing and Price Lining are examples of psychological pricing. Odd Pricing is also a form of psychological pricing, whereby prices are set at odd numbers such as ₹99, ₹149, ₹990 which makes the customers falsely believe that they’re paying a lesser price.

(i) Price Lining: This method is used extensively by retailers. In this, a retailer usually offers a good, better and best assortment of products at different price levels. For example, a retailer of readymade shirts may sell them at three prices: ₹90 for the economy choice, ₹150 for the medium quality and ₹500 for highest quality. Price lining simplifies pricing decisions in the future as retail prices are already set.

(j) Resale Price Maintenance: This type of pricing considers three parties, the manufacturer, the distributor of the manufacturer’s products (who buys the products in bulk), and the consumer. Under this policy, the manufacturer sets the price below which his/her manufactured product will not be sold to the distributors or consumers. He/she may enter into a formal agreement with the distributors of product to not sell below this fixed price in any situation. The basic purpose of this policy is to protect the interest of the manufacturer and create a positive brandimage in the market.

(k) Everyday low pricing: In this type of pricing sellers determine price of the product according to everyday demand and supply. This is followed generally in case of perishable goods. Here price differs even on the basis of early hours of market and late hour of market, for example in vegetable market prices of vegetables are different every day.

(l) Team pricing: In this type of pricing companies sell a package or set of goods or services for a lower price than they would charge if the customer buys all of them separately. This is also called product bundling. Common examples of such pricing may be option packages on new cars, value meals at restaurants and holiday trips.

Please click on below link to download CBSE Class 12 Marketing Types of Pricing Notes