Goodwill : Nature & Valuation Reference:

Multiple Choice Questions

1 Goodwill is __________

(a) Tangible asset

(b) Intangible asset

( c) Fictitious asset

(d) both b & c

2 Goodwill of the firm on the basis of 2 years purchase of average profit of the last 3 years is ₹ 25,000. Find average profit.

(a) ₹ 50,000

(b) ₹ 25,000

(c) ₹ 10,000

(d) ₹ 12,500

3 Calculate the value of goodwill at 3 years purchase when: capital employed ₹ 2,50,000, Average profit ₹ 30,000 and normal rate of return is 10%.

(a) ₹ 3,000

(b) ₹ 25,000

( c) ₹ 30,000

(d) ₹ 15,000

4 The firm earns ₹ 55,000. The normal rate of return is 10%, assets of the firm were ₹ 5,50,000 and liabilities were ₹ 50,000. Value of goodwill by capitalization of average profit will be:

(a) ₹ 1,00,000

(b) ₹ 5,000

( c) ₹ 2,500

(d) ₹ 50,000

5 State whether the following statements are true or false:

(a) Goodwill is a fictitious asset.

(b) Weighted average profit method of calculating of goodwill is used when profits show a trend of financial performance.

(c) Purchased goodwill arises at the time of opening of a new business.

(d) Goodwill can be defined as the present value of anticipated profits.

(e) Under Capitalization of super profit method, goodwill is ascertained by capitalizing the Super profit on the basis of Normal Rate of return.

6 _________ is the excess of actual profit over the normal profit.

7 In a partnership firm, total tangible asset are 14,00,000 and outside liabilities are 4,00,000 then capital employed will be _________.

8 Under ________ method goodwill is the excess of capitalized value of business over net assets.

9 Define Goodwill.

10 How does market situation affect the factor of goodwill?

11 Goodwill of a firm is valued at two years’ purchase of average profits of the last five years. The profits are 2017 ₹.80,000; 2016 ₹.60,000; 2015 ₹.10,000; 2014 ₹.20,000; 2013 ₹.50,000. Calculate the average profit and goodwill of the firm.

12 The goodwill of a firm is valued at three years’ purchase of the average profits of the last five years. The profits are 2017 ₹ 80,000; 2016 ₹ 60,000; 2015 ₹ 10,000; 2014 ₹ 20,000 (Loss); 2013 ₹ 50,000. Calculate the average profit and goodwill of the firm.

13 Monu purchased Sonu’s business from 1st January 2018. The profits disclosed by Sonu’s business for the last three years were as follows:

2016 ₹ 30,000 (including an abnormal gain of ₹ 5,000)

2017 ₹ 40,000 (after charging an abnormal loss of ₹ 10,000)

2018 ₹ 35,000 (excluding ₹ 5,000 as insurance premium of firm’s property now insured)

Calculate the goodwill on the basis of the two year’s purchase of the average profit for the last three years.

14 The following were the profits of the firm for the last three years.

2017 ₹4,00,000 (including an abnormal gain of ₹ 1,50,000)

2016 ₹ 3,00,000 (after charging an abnormal loss of ₹ 2,00,000)

2015 ₹ 5,00,000 (excluding ₹ 2,00,000 payable on insurance of plant and machine)

Calculate the value of the firm’s goodwill on the basis of four year’s purchase of average profits of the last three years.)

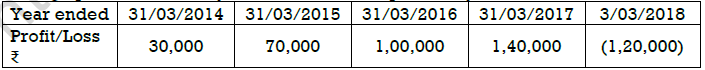

15 A, B and C are partners sharing profits and losses equally. They agree to admit D for equal share. For this purpose, goodwill is to be valued at four years’ purchase of average profit of last five years. Profits for the past five years were:

On 1st April, 2017, 5 cycles costing ₹ 20,000 were purchased and were wrongly debited to Travelling Expenses. Depreciation on cycles was to be charged @25%. Calculate value of goodwill.

16 The profits of a firm for the year ended 31st March for the last five years were as follows : 2009 ₹ 20,000; 2010 ₹ 30,000; 2011 ₹ 40,000; 2012 ₹ 50,000; 2013 ₹ 55,000. Calculate the value of goodwill on the basis of three year’s purchase of weighted average profits after weights 1,2,3,4,5 respectively to the profits for 2009, 2010, 2011, 2012, 2013.

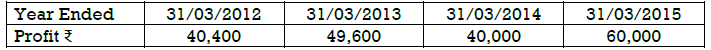

17 Calculate the goodwill of a firm on the basis of three years’ purchase of the weighted average profit of the last four years. Profits for these four years ended 31st March were:

The weights assigned to each year ended 31st March are: 2012-1; 2013-2; 2014-3; 2015-4.

You are provided with the following additional information:

(i) On 31st March, 2014, a major plant repair was undertaken for ₹ 12,000 which was charged to revenue. The said sum is to be capitalized for goodwill calculation subject to adjustment of depreciation of 10% p.a. on Reducing Balance Method.

(ii) The Closing Stock for the year ended 31st March, 2013 was overvalued by ₹ 4,800.

(iii) To cover management cost an annual charge of ₹ 9,600 should be made for the purpose of goodwill valuation.

18 A firm earned net profits during the last three years as 1st year ₹ 18,000; 2nd year ₹ 20,000 and 3rd year ₹ 22,000. The capital investment of the firm is ₹ 60,000. A fair return on capital having regard to the risk involved @10%. Calculate the value of goodwill on the basis of three years’ purchase of the average profits for the last three years.

19 The average net profits Yajur Ltd. expected in the future are ₹ 54,000 per year. The average capital employed in the business is ₹ 2,00,000. The rate of interest expected from capital invested in this class of business is 10%. The remuneration of partners is estimated to be ₹ 10,000 p.a. Find out the value of goodwill on the basis of three years’ purchase of super profits.

20 Rajan and Rajani are partners in a firm. Their capitals were Rajan ₹ 3,00,000; Rajani ₹ 2,00,000. During the year 2012 the firm earned a profit of ₹ 1,50,000. Calculate the value of goodwill of the firm assuming that the normal rate of return is 20%.

22 On April 1, 2013 an existing firm had assets of ₹ 75,000 including cash of ₹ 5,000. The partner’s capital accounts showed a balance of ₹ 60,000 and reserve constituted the rest. If the normal rate of return is 10% and the goodwill of the firm is valued at ₹ 21,000 at three years’ purchase of super profits, find average profit of the firm.

23 (a)A firm had ₹ 2,40,000 worth of fixed assets and ₹ 1,60,000 as current assets on 1st January, 2014. On that date creditors of the firm were ₹ 40,000 partner’s capital ₹ 3,40,000 and general reserve ₹.20,000. If the goodwill of the firm is valued at ₹ 40,000 on the basis of four years purchase of super profit on the basis of 10% return on capital employed. Find out the average profit of the firm.

(a)A firm earns ₹ 15,000 as its annual profit, the rate of normal profit being 10%. The asset of the firm amounted to ₹ 70,000. The value of goodwill is ₹ 40,000 calculated on 4 years of purchase of super profit. Find the value of outside liabilities.

24 The average profit earned by a firm is ₹ 2,50,000 which includes overvaluation of stock of ₹ 10,000 on an average basis. The capital invested in the business is ₹ 14,00,000 and the normal rate of return is 15%. Calculate goodwill of the firm on the basis of 4 times the super profit 14 M/s H&M India has assets of ₹ 5,00,000 whereas liabilities are : Partners’ Capitals- ₹ 3,50,000, General Reserve- ₹ 60,000 and Sundry Creditors- ₹.90,000. If normal rate of return is 10% and goodwill of the firm is valued at ₹ 90,000 at 2 years’ purchase of super profit, find the average profit of the firm.

25 A business has earned average profit of ₹ 1,00,000 during the last few years. Find out the value of goodwill by capitalization method, given that the assets of business are ₹ 10,00,000 and its external liabilities are ₹ 1,80,000. The normal rate of return is 10%.

26 The following information relates to a partnership firm. The profit (2013) ₹.80,000; profit (2014) ₹ 1,00,000; profit (2015) ₹.2,00,000; profit (2016) ₹.1,50,000; profit (2017) ₹ 2,70,000. The average capital employed is ₹ 5,00,000; rate of normal profit is 20%. Find the value of goodwill under the following.

(a)On the basis of three years’ purchase of average profit.

(b)Three years’ purchase of super profit, and

(c) Capitalisation of super profit.

27 From the figures given below, calculate goodwill according the capitalization of average profit method. Actual Average Profit is ₹ 72,000. Normal Rate of Return is 10%, while assets are ₹ 9,70,000 and liabilities ₹ 4,00,000.

28 Priyam and Kiran are in restaurant business having credit balance in their fixed capital accounts as ₹ 2,50,000 each. They have credit balances in their current accounts of ₹ 30,000 and ₹ 20,000 respectively. The firm does not have any liability. They are regularly earning profit and their average profits of last five years is ₹ 1,00,000. If the normal rate of return is 10%, find the value of goodwill by capitalization of Average Profit Method.

29 L and M are partners in a firm. Their capitals are: L ₹ 3,00,000 and M ₹ 2,00,000. During the year ended 31st March, 2010 the firm earned a profit of ₹ 1,50,000. Assuming that the normal rate of return is 20%, calculate the value of goodwill of the firm.

(i)By Capitalization Method; and

(ii)By Super Profit Method if the goodwill is valued at 2 years’ purchase of super profit.

30 Average profit of the firm is ₹ 1,50,000. Total tangible assets in the firm are ₹14,00,000 and outside liabilities are ₹ 4,00,000. In the same type of business, the normal rate of return is 10% of capital employed. Calculate value of goodwill by capitalization of super profit method

Please click on below link to download CBSE Class 12 Accountancy Goodwill Nature And Valuation Worksheet Set A