IMPORTANT THEORY QUESTIONS AND ANSWERS

PART-A PARTNERSHIP AND COMPANY ACCOUNTS

FUNDAMENTALS OF PARTNERSHIP

1. What is meant by Partnership? / Define Partnership.

Ans. According to Section 4 of Indian Partnership Act 1932, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”.

2. What is the status of partnership firm from an accounting viewpoint?

Ans. From the accounting view point, Partnership is a separate business entity from the partners.

3. Which Act of the Parliament specified the number of partners in Partnership?

Ans. Section 464 of Companies Act, 2013.

4. Name the Act under which partnership is governed?

Ans. Partnership Act, 1932.

5. What is a legal status of a firm?

Ans. A firm is not a legal person it is merely a collection of partners.

6. Mention two items that are recorded in Partners Fixed Capital Account.

Ans. i) Capital Withdrawal ii) Fresh Capital Introduced.

7. What are the circumstances under which the balance of the ‘Fixed capitals Accounts’ may change?

Ans. i) Additional capital Introduced. ii) Capital Withdrawn.

8. Would a “Charitable Dispensary” run by 8 members be deemed a Partnership Firm? Give reason in support of your answer.

Ans. Charitable Dispensary run by 8 members cannot be deemed a Partnership firm because:

(i) In Partnership, there must be a business;

(ii) There must be sharing of profits from such business among the partners.

9. Why is it preferable to have a written agreement between the partners?

Ans. To avoid all kinds of misunderstanding and disputes among the partners.

10. Why is that the Fixed Capital Account of a partner does not show “Debit Balance” in spite of regular and Consistent losses year after year?

Ans. When the capitals are fixed, the Capital Account of a partner will never show debit balance since, all transactions between the firm and the partner are recorded in Current Account.

11. A & B are two working partners whereas B is sleeping partner in the firm. B wants to inspect books of Accounts but A denies. What shall be done?

Ans. A is wrong, he cannot deny as B holds the right to inspect the accounts.

12. Under fixed capital method, partner’s drawings are shown in which account?

Ans. Partners Current A/cs.

13. Debit balance of Partners Current A/Cs is shown on which side of the balance sheet?

Ans. Assets side.

14. Give the journal entry of P & L credit balance.

Ans. Profit and Loss A/c Dr To Profit and Loss Appropriation A/c.

15. If the partners’ capitals account are fixed where will you record drawings of partners?

Ans. Debit side of partners current A/c.

16. How will you calculate interest on drawings when date of withdrawal is not given?

Ans. It will be calculated on the average basis of 6 months.

17. In which account interest on partners loan is debited and why?

Ans. It is debited to Profit and Loss Account because it is a charge against theprofit.

18. A and B are partners in a firm sharing profit in the ratio of 3:2. They had advanced to the firm a sum of Rs. 30,000 as a loan in their profits sharing ratio on 1st Oct. 2014. The partnership deed is silent on the question of interest on loan for partners. Compute the interest payable by the firm to the partners, assuming the firm closes its books on 31st March.

Ans. A- Rs.540 B- Rs. 360. (Note: In the absence of Partnership deed, 6% p.a will be allowed as Interest on Loan)

19. In the absence of Partnership deed, how are mutual relations of partners governed?

Ans. In the absence of |Partnership deed, mutual relations are governed by The Indian partnership Act 1932.

20. A,B and C are partners and decided that no interest on drawings is to be charged from any Partner. But after one Year ‘C’wants that interest on drawings should be charged from every partner. State how ‘C’ can do this?

Ans. He can do so only by changing the Partnership deed with the consent of all partners.

21. Can a Partner be exempted from sharing the losses in a firm? If yes, under what circumstances?

Ans. Yes, if Partnership Deed provides so.

22. What share of profits would a “sleeping partner” who has contributed 75% of the total Capital get in the absence of Partnership Deed?

Ans. In the absence of Partnership Deed, a sleeping partner will get equal share of profits.

ADMISSION OF A PARTNER

23. Define goodwill.

Ans. Goodwill is the value of the reputation of a firm in respect of profits expected in future, over and above the normal profits.

24. What is Purchased Goodwill?

Ans. When one business is taken over by another business, the excess of purchase consideration over its net value (assets – liabilities) is termed as purchased goodwill.

25. What is Non- Purchased Goodwill?

Ans. Non-Purchased Goodwill is an internally generated goodwill which arises because of favourable factors that a business possesses.

26. Why is Goodwill considered as an Intangible Asset but not a Fictitious Asset?

Ans. It is not fictitious asset because it has a realizable value. It is an intangible asset because it cannot be seen and touched.

27. State two occasions when there is a need of valuation of goodwill?

Ans. i) When a new partner is admitted.

ii) When there is a change in the profit sharing ratio among the existing partners.

28. How does location affect the Goodwill of a business?

Ans. If the business is located at a favorable and prominent location then it increases the value of Goodwill. It is the location of the business in the market which, to a great extent, helps in attracting the customers. Thus, a favorable location of business enhances its Goodwill.

29. When will you record Goodwill in the book, as per Accounting Standard-10(AS-10)?

Ans. According to AS-10, Goodwill should be recorded in the books only when some consideration in money or money’s worth has been paid for it.

RETIREMENT OF A PARTNER

30. Give two circumstances in which Gaining Ratio is computed.

Ans. i) When a partner retries or dies.

ii) When there is a change in the profit sharing ratio.

31. If the retiring partner is not paid fully immediately on retirement. How should his capital account be shown in subsequent Balance Sheet?

Ans. If the retiring partner is not fully paid immediately on retirement, the remaining balance of his capital account will be transferred to his loan account and will be shown as his loan account on liabilities side of the Balance Sheet.

DEATH OF A PARTNER

32. What are the two methods of calculating profits of a retiring/Deceased Partner?

Ans. (a) Time Basis and (b) Turnover Basis

33. On the death of a partner, his executor is paid the share of profits of the dying partner for the relevant period. Where is this payment recorded?

Ans. This payment is recorded in Profit and Loss Suspense a/c i.e. Profit and Loss Suspense a/c……… Dr To Deceased Partners Capital a/c

CHANGE IN PROFIT SHARING RATIO

34. What is meant by reconstitution of a Partnership firm?

Ans. Any change in the relationship among the partners in a firm amounts to reconstitution of partnership firm. Eg; Admission of a new Partner, Retirement and death of a Partner and change in Profit sharing ratio.

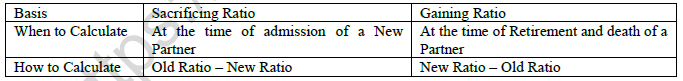

35. Distinguish between Sacrificing Ratio and Gaining Ratio.

36. What is meant by change in profit sharing ratio among the existing partners?

Ans. Change in profit- sharing ratio means that one(or more) partner(s) acquires share of profit from anotherpartner(s).

37. When there is a change in the profit-sharing ratio among the existing partners, does it require revaluation of assets and reassessment of liabilities?

Ans. Yes. Because profit or loss up to the change in profit-sharing ratio, should be credited or debited to theaccounts of the partners in their old profit-sharing ratio.

38. Who should compensate in the case of change in profit-sharing ratio of existing partners?

Ans. The gaining partners should compensate the sacrificing partners in case of change in profit-sharing ratio of existing partners.

DISSOLUTION OF PARTNERSHIP FIRM

39. When can a firm be compulsory dissolved?

Ans. When the business becomes unlawful or on the insolvency of all or one partners a firm can be compulsory dissolved.

40. What is a private debt?

Ans. Debt owned by a partnerpersonally to any other person is called private debts.

41. What is meant by firm’s debt?

Ans. Debts of the firm owed to the third parties is called firm’s debts.

42. What is the liability of the partners for firm’s debt?

Ans. Partners are jointly and severally liable for firm’s debt.

43. What amount of partner’s private property can be utilized for payment of firm’s debt?

Ans. Surplus of partner’s private property over private debts can be applied for firm’s debts.

44. Provisions for doubtful debts Rs.15,000, Provisions for Depreciation Rs.3,10,000. Provident Fund Rs.58,000 has been transferred to the credit side of Realization Account. For which item the payment is to be made by the firm.

Ans. Provident Fund.

45. Why is partner’s loan not transferred to Realization Account.

Ans. Partner’s loan is not an outside liability.

46. How is Cash/Bank account closed at the time of dissolution of the firm?

Ans. After paying the amount due to the partners the Cash/Bank amount automatically gets closed.

47. Name the account which co-exists with Partner’s Capital Account till the final payment to partner is made.

Ans. Cash/Bank Account.

48. The Capital Account of one of the partners who is solvent, shows a debit balance. How will this be settled?

Ans. The partner will be required to bring cash equal to his debit balance,

49. Can there be a balance in Cash Account after partners have been paid their final balance?

Ans. No.

50. Give the objects of preparing realization account on the dissolution of a firm.

Ans. (a) To close various assets and liabilities account.

(b) To find out the net profit/loss on realization of various assets and settlement of various liabilities.

51. In the case of dissolution of partnership firm mention the order in which the liabilities of a firm are paid.

Ans. (a) Outside liabilities of the firm (e.g. Creditors, loan, bank overdraft, bills payable, advances from partner's relative's etc.)

(b) Loans extended by the partners

(c) Capital contribution of the partners

(d) Any surplus left is distributed among all partners in their profit sharing ratio.

52. A’s Capital Account has a Credit Balance of Rs.1,00,000. Bank Balance is Rs.4,50,000 A’s Loan Account is showing a debit balance of Rs.36,000. Show the treatment for A’s Loan A/c.

Ans. A’s loan a/c will be debited to A’s Capital a/c.

A’s Capital A/c Dr. 36,000

To A’s Loan A/c 36,000

(Note: If A’s loan A/c shows a credit balance, it will be paid off through Cash A/c.)

53. Why should Debtors be transferred to Realisation Account at gross value and not at net value(Gross value- Provision for Doubtful Debts) at the time of Dissolution of a firm?

Ans.It is so because they are two separate accounts, namely,(i) Debtors, and (ii) Provision for Doubtful Debts. If debtors are transferred at a net amount, the balance will be outstanding both the accounts and thus, the two accounts will not close.

Please click on below link to download CBSE Class 12 Accountancy All Chapters Worksheet