Accounting for Partnership Firms - Fundamentals

Interest on Drawings

1 Mr. A withdrew Rs.1,20,000 p.a @10% p.a. Calculate interest on drawing of Mr. A at the end of the financial year.

(Ans. Rs.6,000)

2 Mr. B withdrew Rs. 1,20,000 p.a. @10%. Calculate the interest on drawings of Mr. B at the end of the financial year. (Ans. Rs.12,000)

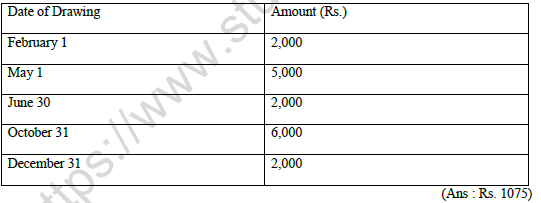

3 In a partnership, partners are charged interest on drawings @15% p.a. During the year ended 31st December, 2013 a partner drew as follows. Calculate interest on drawing.

4 Calculate interest on drawings of Rajesh @10% p.a. for the year ended 31st December, 2014 in each of the below mentioned cases.

(i)If he withdrew Rs. 2,000 per month in the beginning of every month. (Ans : Rs. 1,300)

(ii) If he withdrew Rs. 2,000 per month in the end of every month. (Ans : Rs. 1,100)

(iii) If he withdrew Rs. 2,000 per month in the middle of every month. (Ans : Rs. 1,200)

5 Calculate interest on drawings of Shiv @10% p.a. for the year ended 31st December, 2014 in each of the below mentioned cases.

(i)If he withdrew Rs. 2,000 per quarter in the beginning of every quarter. (Ans : Rs.500)

(ii) If he withdrew Rs. 2,000 per quarter in the end of every quarter. (Ans : Rs. 300)

(iii) If he withdrew Rs. 2,000 per quarter in the middle of every quarter. (Ans : Rs. 400)

6 Mr. X and Mr. Y started business on 1st April, 2013 with capitals of Rs. 5,00,000 and Rs. 3,00,000 respectively. Calculate interest on drawings of Mr. X @10% p.a. for the year ended 31st December 2015 in each of the following alternative cases :

(i)If he withdrew Rs. 2,000 per month in the beginning of every month. (Ans : Rs. 750)

(ii) If he withdrew Rs. 2,000 per month in the end of every month. (Ans : Rs.600)

(iii) If he withdrew Rs. 2,000 per month in the middle of every month. (Ans : Rs.675)

(iv)If he withdrew Rs. 6,000 in the beginning of every quarter. (Ans : Rs.900)

(v) If he withdrew Rs. 6,000 in the end of every quarter. (Ans : Rs. 450)

(vi) If he withdrew Rs. 6,000 in per quarter. (Ans : Rs. 675)

Interest on Capital

7 L and M started business on 1st April, 2013 with capitals of Rs.3,00,000 and Rs.1,80,000 respectively. There is no withdrawal or addition of capital during the year. Calculate the interest on capital @ 12% p.a. for the year (a) 31st March, 2014 and (b) on 31st December, 2013.

(Ans. (a) L Rs.36,000; M Rs. 21,600 (b) L Rs. 27,000; M Rs. 16,200.

8 X and Y started business on 1st April, 2015 with capitals of Rs.3,00,000 and Rs.1,80,000 respectively. On 1st May 2015 he introduced an additional capital of Rs.60,000 and Y withdrew Rs.30,000 from his capital. On 1st October 2015, X withdrew Rs.1,20,000 from his capital and Y introduced Rs. 1,50,000. Interest on capital is allowed @6% p.a. Calculate the interest on capital for the year ending 31st March, 2016.

(Ans : IOC of X Rs. 17,700 and IOC of Y Rs. 13,650.

9 On 31st March 2013 after the close of A/c, the capital accounts of Mr. X and Mr. Y stood in the books of the firm at Rs. 2,40,000 and Rs. 3,00,000 respectively. On 1st May, 2012, Mr. X introduced an additional capital of Rs. 60,000 and Mr. Y withdrew Rs. 30,000 from his capital. On 1st October, 2012, Mr. X withdrew Rs. 1,20,000 from his capital and Y introduced Rs. 1,50,000. Interest on capital is allowed @6% p.a. Calculate the interest on capital for the year ending 31st March, 2013.

(Ans : Total IOC of Mr. X Rs 17,700 and Mr. Y Rs. 13,650)

10 Leena and Kavita are partners sharing the profits and losses in the ratio of 2:3 with capitals of Rs. 20,000 and Rs. 10,000 respectively. Show the distribution of profit/loss for the year 2015 by preparing the relevant account in each of the following in the below cases.

(i)If the partnership deed is silent as to the interest on capital and the trading profits for the year are Rs. 1,600.

(Ans : Divisible Profit Leena Rs. 640; Kavita Rs. 960)

(ii)If the partnership deed provides for interest on capital @6% and the trading losses for the year are Rs. 1,600.

(Ans : Divisible Loss Leena Rs. 640; Kavita Rs. 960)

(iii)If the partnership deed provides for interest on capital @6% and the trading profits for the year are Rs. 2,200.

(Ans : Divisible Profit Leena Rs. 160; Kavita Rs. 240)

(iv)If the partnership deed provides for interest on capital @6% and the trading profits for the year are Rs. 1,650.

(Ans : Divisible Profit Leena Rs. 1,100; Kavita Rs. 550)

(v) If the partnership deed provides for interest on capital @6% even if it involves the firm in loss and the trading profits for the year Rs. 1,600.

(Ans : In Profit & Loss a/c Divisible Loss Leena Rs. 80; Kavita Rs. 120)

11 (Rent paid to a Partner)

L and G are partners sharing profits and losses in the ratio 2:3 with capital contribution of Rs. 2,00,000 and Rs. 3,00,000 respectively. Firm is working in the premises owned by G. Monthly rent of Rs. 10,000 is fixed for the premises. Show the distribution of profits/losses for the year 2013 in the following cases.

(a)If yearly profit before charging rent of premises are Rs. 2,00,000.

(b)If yearly profits before charging rent of premises are Rs.1,00,000.

(c)If yearly loss before charging rent of premises is Rs.60,000.

12 (Profit & Loss Appropriation Account)

P and Q are partners in a firm. Their capitals as on 1st January, 2013 were Rs. 2,20,000 and Rs. 1,80,000 respectively. They share profits and losses equally. On 1st April, 2013, they decided that their capitals should be Rs.2,00,000 each. The necessary adjustments in the capitals were made by withdrawing or introducing cash. According to partnership agreement, interest on capital is to be allowed at 10% p.a. P is to get an annual, interest on capital is to be allowed at 10% p.a. P is to get an annual commission of Rs. 6,000 and Q is allowed a monthly salary of Rs.1,000. It was found that Q was regularly withdrawing his monthly salary and P gifted a microwave oven to his daughter taken from the firm costing Rs. 11,500. The manager of the firm is entitled to a commission of 10% of the profits before any adjustment is made according to the partnership agreement. Net profit for the year ended on 31st December 2013, before charging interest on capital and salary was Rs. 1,20,000. Prepare Profit and Loss Appropriation A/c and Partners’ Capital A/c.

(Ans : Share of Profit P: Rs. 25,000; Q: Rs. 25,000)

13 A and B are partners sharing profits in the ratio of 3:2 with capitals of Rs. 50,000 and Rs. 30,000 respectively. Interest on capital is agreed @10% p.a. B is to be allowed an annual salary of Rs. 3,000. During the year they withdrew Rs. 6,000 each. Profit for the year amounted to Rs.18,000 prior to interest on capital and before charging depreciation @10% on furniture valued Rs.10,000 and before writing off Bad Debts of Rs.500. Manager is to be allowed a commission of

10% after charging such commission. Prepare profit and Loss Appropriation A/c.

(Divisible Profit -A: Rs.4,200; B : Rs.2,800)

14 X and Y started a partnership business on 1st January, 2013. They contributed Rs. 80,000 and Rs.60,000 respectively as their capitals. The terms of the partnership agreement are as follows – 20% of profits is to be transferred on reserve. Interest on capital @12% p.a. and interest on drawings @10% p.a. X and Y to get a monthly salary of Rs.2,000 and Rs.3,000 respectively. X is entitled to a commission of Rs.7,000. Sharing of profit or loss will be in the ratio of their capital contribution. The profit for the year ended 31st December,2013, before making above appropriations was Rs. 1,25,375. The drawings of X and Y were Rs.40,000 and Rs.50,000 respectively.

(Ans : Divisible Profits X : Rs.12,000; Y : Rs. 9,000)

15 The Partnership agreement of Ram and Shyam provides that profits will be shared equally. Ram will be allowed a salary of 400 per month. Shyam who manages the sales department will be allowed a commission equal to 10% of the net profit after allowing Ram’s salary. 7% interest will be allowed on partner’s fixed capital. 5% interest will be charged on partner’s annual drawings. The fixed capitals of Ram and Shyam are Rs. 1,00,000 and Rs.80,000 respectively. Their annual drawings were Rs.16,000 and Rs.14,000 respectively. The net profit for the year ending March 31st, 2013 amounted to Rs.40,000. Prepare Profit & Loss Appropriation Account.

(Ans Profit Ram: Rs.9,915; Shyam: Rs.9,915)

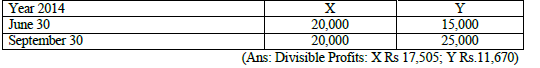

16 X and Y were partners in a firm sharing profits in the ratio of 3:2. On 1st January 2014 their fixed capitals were Rs.3,00,000 and Rs.2,50,000 respectively. On 1st July 2014, they decided that their total fixed asset capital should be RS.6,00,000. They further decided that this capital should be in their profit sharing ratio. Accordingly, they introduced extra capital or withdrew excess capital. The partnership deed provided for the following: interest on capital @12%p.a.; interest on drawings @18% p.a. A monthly salary of Rs.2,000 to X and monthly salary of Rs.2,000 to X and a monthly salary of Rs. 1,500 to Y. The drawings of X and Y during the year were :

17 A, B and C started a partnership business. A contributed Rs. 30,000 for the whole year, B contributed Rs.Rs.25,000 and after 6 months further introduced Rs. 10,000 as capital. C invested Rs. 40,000 but withdrew Rs. 10,000 at the end of 5th month. Profit of the firm for the year was Rs.23,000. You are required to apportion the profit of the firm.

(Ans : Divisible Profit: A Rs 6,000; B Rs.6,000 and C Rs. 11,000)

18 (Guarantee of Minimum Profit to Partners)

A, B and C are partners sharing profits in the ratio 5:3:2. According to the partnership agreement C is to get minimum amount of Rs. 10,000 as his share of profits every year. The net profit for the year 2013 amounted to Rs.40,000. Prepare Profit & Loss Appropriation Account.

(Ans : Divisible Profit: A Rs.18,750; B Rs. 11,250 and C Rs. 10,000)

19 X, Y Z entered into partnership on April 1, 2013. There is no agreement as to the sharing profits except that X guaranteed Z’s share of profits after, charging interest would not be less than Rs.7,800 p.a. The initial capital was provided as follows: X Rs.1,00,000; Y Rs.60,000; Z Rs.20,000 (which was increased on 1st October 2013 to Rs.30,000). In addition to the above capitals X and Y made temporary loan to firm as follows : X Rs.40,000 advanced on 1st March, 2013 was Rs. 21,000 before providing for interest. Show the Profit & Loss Account for the year.

(Ans : Divisible Profit X Rs.4,600 ; Y Rs.6,200 ; Z Rs. 7,800)

20 A, B and C are in partnership. A and B sharing profits in the ratio of 3:1 and C receiving an annual salary of Rs.32,000 plus 5% of the profits after charging his salary and commission, or 1/4th of the profit of the firm whichever is larger. Any excess of the latter over the former received by C is, under the partnership deed, to be borne by A and B in the ratio of 3:2. The profit for the year 2013 came to Rs.1,68,000 after charging C’s salary. Show the distribution of profits among partners.

(Ans : Divisible Profit A Rs.1,14,000 ; B Rs. 36,000 ; C Rs. 50,000)

21 A and B share profits and losses in the ratio of 2:1 and as from 1st April, 2013, they admit C who is to have one-tenth share of the profit with a guaranteed minimum of Rs. 16,000. A and B continue to share profits as before. The profits for the year ending 31st March,2014 amount to Rs.1,00,000.

(Ans : Divisible Profit A Rs.56,000; B Rs. 28,000 ; C Rs. 16,000)

Please click on below link to download CBSE Class 12 Accountancy Fundamentals Partnership Worksheet Set D