NCERT Solutions Class 12 Economics Chapter 5 Excess Demand and Deficient Demand have been provided below and is also available in Pdf for free download. The NCERT solutions for Class 12 Economics have been prepared as per the latest syllabus, NCERT books and examination pattern suggested in Class 12 by CBSE, NCERT and KVS. Questions given in NCERT book for Class 12 Economics are an important part of exams for Class 12 Economics and if answered properly can help you to get higher marks. Refer to more Chapter-wise answers for NCERT Class 12 Economics and also download more latest study material for all subjects. Chapter 5 Excess Demand and Deficient Demand is an important topic in Class 12, please refer to answers provided below to help you score better in exams

Chapter 5 Excess Demand and Deficient Demand Class 12 Economics NCERT Solutions

Class 12 Economics students should refer to the following NCERT questions with answers for Chapter 5 Excess Demand and Deficient Demand in Class 12. These NCERT Solutions with answers for Class 12 Economics will come in exams and help you to score good marks

Chapter 5 Excess Demand and Deficient Demand NCERT Solutions Class 12 Economics

I. Very Short Answer Type Questions

Question. What is meant by excess demand in macroeconomics?

Answer: When in an economy aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be an excess demand.

Question. Define inflationary gap.

Answer: When in an economy aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be an excess demand and the gap is called inflationary gap.

Question. Give the meaning of deficient demand.

Answer: When in an economy aggregate demand falls short of aggregate supply at full employment level, the demand is said to be as deficient demand.

Question. Define deflationary gap.

OR

Give the meaning of deflationary gap.

Answer:” When in an economy aggregate demand falls short of aggregate supply at full employment level, the demand is said to be deficient demand and the gap is called deflationary gap.

Question. State two measures by which a central bank can attempt to reduce the inflationary gap.

Answer:

1. Increase in cash reserve ratio.

2. Increase in marginal requirement.

Question. What is the impact of increase in margin requirements?

Answer: Increase in margin requirements discourages borrowings and decreases the aggregate demand.

Question. Give the meaning of full employment.

Answer: Full employment equilibrium refers to the situation where aggregate demand = aggregate supply and all those who are able to work and willing to work (at the existing wage rate) are getting work.

Question.Give the meaning of involuntary unemployment.

Answer: Involuntary unemployment refers to a situation in which all able and willing persons to work at existing wage-rate do not find work. They are rendered unemployed against their wish. Hence, it is termed as involuntary unemployment.

Question. Is it necessary that equality between AD and AS is established at the full employment level?

Answer: No, it is not necessary that full employment occurs when AD = AS. Equilibrium can be achieved at full employment level, under employment level or at over full employment level.

Question. What is meant by full employment equilibrium?

Answer: Full employment equilibrium refers to a situation when equilibrium is attained i.e., aggregate demand is equal to aggregate supply at full employment level.

Question. What is underemployment equilibrium?

Answer: Underemployment equilibrium refers to a situation when equilibrium is attained i.e., aggregate demand is equal to aggregate supply below full employment level or when resources are not fully employed.

Question. What is the meaning of over full employment equilibrium?

Answer: Over full employment level refers to a situation when equilibrium is attained, i.e., aggregate demand is equal to aggregate supply beyond the full employment level.

II. Multiple Choice Questions

Question. Name the situation under which aggregate demand exceeds aggregate supply at the full employment level,

(a) Excess demand

(b) Excess supply

(c) Deflationary gap

(d) None of them

Answer: (a)

Question. Name the situation under which aggregate demand falls short of aggregate supply at full employment level.

(a) Excess demand

(b) Excess supply

(c) Inflationary gap

(d) None of them

Answer : (b)

Question. What is the impact of deficient demand on production and employment?

(a) Increase

(b) Decrease

(c) Remains constant

(d) None of them

Answer: (b)

Question. The various fiscal policy measures that can increase aggregate demand and thus, control the problem of deficient demand are:

(a) Increasing the level of government expenditure.

(b) Reduction in the level of taxes.

(c) A mix of increasing government expenditure and decreasing the rate of taxes

(d) All of them

Answer: (d)

Question. The various fiscal policy measures that can decrease aggregate demand, and thus, control the problem of excess demand are:

(a) Reducing the level of government expenditure.

(fa) Increasing the amount of taxes.

(c) A mix of reducing government expenditure and increasing tax rates

(d) All of them

Answer: (d)

Question. The various monetary policy measures that can increase aggregate demand, and thus, control the problem of deficient demand are:

(a) Reduction in bank rate.

(b) Purchase of government securities in the open market by the central bank.

(c) Reduction in CRR and SLR.

(d) All of them

Answer: (d)

Question. The various monetary policy measures that can decrease aggregate demand, and thus, control the problem of excess demand are:

(a) Increase in the bank rate.

(b) Sale of government securities in the open market by the central bank.

(c) Raising CRR and SLR.

(d) All of them

Answer: (d)

III. Short Answer Type Questions

Question. What are the reasons or causes for excess demand?

Answer: The main reasons for excess demand are apparently the increase in the following

components of aggregate demand:

1. Increase in household consumption demand due to rise in propensity to consume.

2. Increase in private investment demand because of rise in credit facilities.

3. Increase in public (government) expenditure.

4. Increase in export demand.

5. Increase in money supply or increase in disposable income.

Question. What are impacts or effects of excess demand on price, output, employment?

Answer:

1. Effect on General Price Level: Excess demand gives a rise to general price level because it arises when aggregate demand is more than aggregate supply at a full employment level. There is inflation in economy showing inflationary gap.

2. Effect on Output: Excess demand has no effect on the level of output. Economy is at full employment level and there is no idle capacity in the economy. Hence output can’t increase.

3. Effect on Employment: There will be no change in the level of employment also. The economy is already operating at full employment equilibrium, and hence there is no unemployment.

Question. What are the reasons or causes for deficient demand?

Answer: The main reasons for deficient demand are apparently the decrease in four components of aggregate demand:

1. Decrease in household consumption demand due to fall in propensity to consume.

2. Decrease in private investment demand because of fall in credit facilities.

3. Decrease in public (government) expenditure.

4. Decrease in export demand.

5. Decrease in money supply or decrease in disposable income.

Question. What are the impacts or effects of deficient demand on price (output) employment?

Answer:

1. Effect on General Price Level: Deficient demand causes the general price level to fall because it arises when aggregate demand is less than aggregate supply at full employment level. There is deflation in an economy showing deflationary gap.

2. Effect on Employment: Due to deficient demand, investment level is reduced, which causes involuntary unemployment in the economy due to fall in the planned output.

3. Effect on Output: Low level of investment and employment implies low level of output.

Question. Explain the role of Government expenditure and Open Market Operation in reducing AD/excess demand.

Answer: (a) Government Expenditure:

1. Government has to invest huge amount on public works like roads, buildings, irrigation works, etc.

2. During inflation, government should curtail (reduce) its expenditure on public works like roads, buildings, irrigation works thereby reducing the money income of the people and their demand for goods and services.

(b) Open Market Operation:

1. It consists of buying and selling of government securities and bonds in the open

market by central bank.

2. In a situation of excess demand leading to inflation, central bank sells government securities and bonds to commercial bank. With the sale of these securities, the power of commercial bank of giving loans decreases, which will control excess demand.

Question. Differentiate between full employment and underemployment equilibrium.

Answer:

| Full Employment Equilibrium |

Basis |

Underemployment Equilibrium |

| Full employment equilibrium refers to the situation where aggregate demand is equal to aggregate supply, and all those who are able to work and willing to work (at the existing wage rate) are getting work. | Meaning | Underemployment equilibrium refers to the situation where AD is equal to AS, but all those who are able to work and willing to work (at the existing wage rate) are not getting work. |

| Full employment equilibrium is a stable equilibrium and real output reaches at its maximum point.. | Stable / Unstable | Underemployment equilibrium is not a stable equilibrium (unstable equilibrium) and real output does not reach to its maximum. |

| Departure from full employment equilibrium may cause inflationary gap or deflationary gap | Departure | Departure from underemployment equilibrium does not cause inflationary or deflationary gap |

Question. What is meant by Margin Requirement? How does the Central Bank use this measure to control deflationary conditions in an economy?

Answer:

1. Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security.

2. So, the difference between the value of security and value of loan is called marginal requirement.

3. In a situation of deficient demand leading to deflation, central bank decreases marginal requirements. This encourages borrowing because it makes people get more credit against their securities.

IV. True Or False

Are the following statements true or false? Give reasons.

Question. To control deflation the central bank should increase the bank rate.

Answer: False. The central bank should decrease the bank rate in order to control deflation.

Question. Purchase of government securities by the central bank in the open market is an appropriate policy to check depression in the economy.

Answer: True. To check depression the central bank should purchase government securities from the open market, so as to increase the availability of credit in the economy.

Question. To correct the deflationary gap, availability of credit should be increased.

Answer: True. Availability of credit should be increased to raise the level of aggregate demand.

Question. Fiscal policy has a direct effect on producing sector of the economy.

Answer: False. Fiscal policy has a direct effect on all the sectors of the economy.

Question. Equilibrium below full employment level does not lead to fall in output level.

Answer: False. Equilibrium below the full employment level leads to deflation, which causes low level of investment and employment implies low level of output.

V. Long Answer Type Questions

Question. Explain the meaning of underemployment equilibrium. Explain two measures by which full employment equilibrium can be reached.

Answer:

1. Underemployment equilibrium refers to a situation when equilibrium is attained i.e., aggregate demand is equal to aggregate supply below full employment level or when resources are not fully employed.

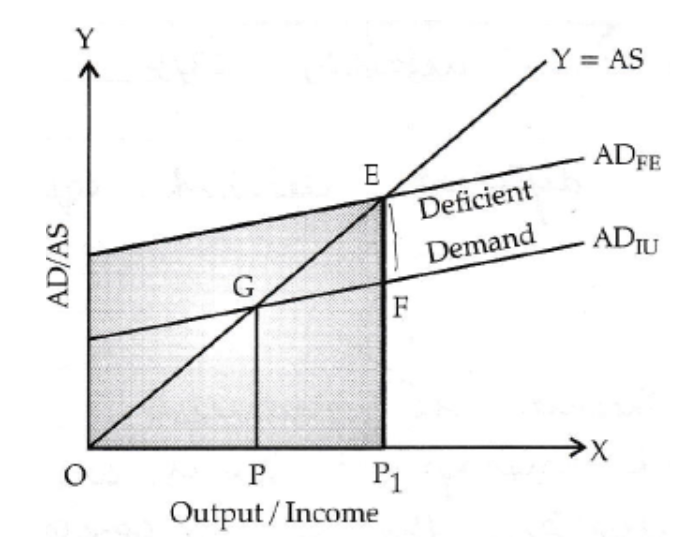

2. In the above diagram full employment level of national income is attained at point E, but due to deficient demand, aggregate demand shifts downward from AD to AD0 and hew equilibrium is attained at point E1; which is below full employment level. The aggregate demand shifts downward because of the following reasons.

(i) Decrease in household consumption demand due to fall in propensity to consume.

(ii) Decrease in private investment demand because of fall in credit facilities.

(iii) Decrease in public (government) expenditure.

(iv) Decrease in export demand.

(v) Decrease in money supply or decrease in disposable income.

3. In order to achieve full employment equilibrium deficiency of demand must be corrected through additional investment expenditure. In the diagram deficiency of AD

= AB. Thus, AB amount of additional investment is required to reach the level of full employment.

Question. Differentiate between inflationary gap and deflationary gap. Show deflationary gap on a diagram. Can this gap exist at equilibrium level? Explain.

Answer: Inflationary Gap:

Inflationary gap occurs when aggregate demand (AD) exceeds aggregate supply (AS) at full employment level of output. In this case, money income rises to a higher equilibrium, but real income (being at full employment output level) remains unchanged.

As a result, there is an upward rise in prices because the consumers compete for limited supply of output and bid prices up.

In other words, inflationary gap reflects that at full employment level of output, real income cannot rise, but the prices rise to the extent that AD > AS at full employment.

Inflationary gap continues to prevail until either AD contracts to the level consistent with the full employment level or AS is expanded through economic growth.

In Figure 2A, Yf represents full employment output (i.e., the maximum output the economy can produce in a given short period).

The position of AS line (i.e. 45 ° line which represents Y = C + I + G) is such that at Yp AD is greater than AS by the amount AB. Thus, AB is the measure of inflationary gap, which is another name for excess demand measured at Yf.

Deflationary Gap:

Deflationary gap prevails when aggregate demand (AD) is less than aggregate supply (AS) at full employment level of output. In this case, income equilibrium occurs while some resources are unemployed.

In other, words, deflationary gap depicts unemployment situation attributable to the fact that at full employment level of output, AD <AS.

Thus, deflationary gap is measured as the difference between AD and AS at full employment, Deflationary gap, and the resultant conditions of unemployment and sluggish economic activity, will persist until a higher level of aggregate demand consistent with full employment is achieved.

In Figure 2B, Yf represents full employment output. The position of AS line (i.e., 450 line) is such that at Yp AD is less than AS by the amount BA. Thus, BA is the measure of deflationary gap, which is the same thing as deficient demand measured at Yf.

Question. Explain the concept of Inflationary Gap. Explain the role of Repo Rate in reducing this gap.

Answer: Excess demand or inflationary gap is the excess of aggregate demand over and above its level required to maintain full employment equilibrium in the economy. It implies two things-

1) Planned aggregate demand in the economy happens to exceed its full employment level.

2)The level of aggregate demand surpasses the level of aggregate supply even when the available factors are fully utilized.

Role of Repo rate: Repo rate relates to the loans offered by the RBI to the commercial banks not without collateral. During inflation Repo rate is increased. As a follow-up action, the commercial banks rise the market rate of interest. This reduces the demand for credit and thus inflation can be combated.

Question. Explain the concept of Deflationary Gap and the role of ‘Open Market Operations’ in reducing this gap.

Answer:

Deflationary Gap-Deflationary gap is the deficiency of AD required to maintain full employment equilibrium Deflationary gap occurs when AD < AS (corresponding to full employment level). Open market operation is the policy that focuses on increasing and decreasing the stock of liquidity (or cash balances) with the people as well as with the Commercial Banks, through sale and purchase of securities by the Central Bank. During the situations of Deflationary Gap, when cash balances need to be increased (to stimulate the level of Aggregate Demand), the Central Bank starts buying securities. Purchase of securities injects purchasing power into the money market. Cash balances of the Commercial banks start picking up. This enhances their capacity to create credit. Consequent upon the greater flow of credit flow' in the economy, Aggregate Demand is increased Deflationary gap is corrected.

Question. What is ‘deficient demand’? Explain the role of ‘Bank Rate’ in removing it.

Answer:

1. When in an economy, aggregate demand falls short of aggregate supply at full employment level, the demand is said to be a deficient demand.

2. It can be explained with the help of following diagram:

3. (i) Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to general public.

(ii) In a situation of deficient demand leading to deflation,

• Central bank decreases bank rate that encourages commercial banks in borrowing from central bank as it will decrease the cost of borrowing of commercial bank.

• Decrease in bank rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

• Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

• Thus, expenditure on investment and consumption increase, which will control the deficient demand.

Question. What is ‘excess demand’? Explain the role of ‘Reverse Repo Rate’ in removing it.

Answer:

1. When in an economy, aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be an excess demand.

2. It can be explained with the help of following diagram:

ATTACH IMAGE

3. (i) Reverse Repo Rate is the rate at which the central bank (RBI) borrows money from commercial bank.

(ii) In a situation of excess demand leading to inflation, Reverse repo rate is increased, it encourages the commercial bank to park their funds with the central bank to earn higher return on idle cash. It decreases the lending capability of commercial banks,which controls excess demand.

VI. Higher Order Thinking Skills

Question. It is necessary that the equilibrium level of national income is always at a full employment level. Explain this statement.

Answer: It is not necessary because equilibrium level of national income can be attained:

1. At full employment level.

2. Over full employment level, or above the full employment level (in case of excess demand).

3. Underemployment level or below full employment level (in case of deficient demand).

1. At full employment equilibrium level: Full employment equilibrium refers to a situation when equilibrium is attained, i.e., aggregate demand is equal to aggregate supply at full employment level.

In the given diagram, full employment level of national income and equilibrium level is attained at Point E. So, equilibrium is possible at full employment level.

2. Over full employment level or Above the full employment level: Over full employment level refers to a situation when equilibrium is attained, i.e., aggregate demand is equal to aggregate supply beyond full employment level.

In the given diagram full employment level of national income is attained at point E, but due to the excess demand, the aggregate demand shifts upward from AD0 to AD0

Due to shift in AD the new equilibrium is attained at point E1 which is above the equilibrium level.

3. Underemployment equilibrium: It refers to a situation when equilibrium is attained,i.e., aggregate demand is equal to aggregate supply below the full employment level or when resources are not fully employed.

In the above diagram full employment level of national income is attained at point E but due to deficient demand, aggregate demand shifts downward from AD0 to AD1 and new equilibrium is attained at point Et, which is below full employment level.

VII.Value Based Questions

Question. In Indian market, money supply is the reason of rising price level. Explain any one measure of central bank to control money supply? [3 Marks]

Answer: Explain any one reason:

1. Bank rate

2. Cash reserve ratio (CRR)

3. Statutory liquidity ratio (SLR)

Question. Excess money supply is necessary for rapid economic development but it creates inflationary situation. Write any two fiscal measures to control inflationary situation.

Answer: Fiscal Measures:

1. Increase in tax rates (Explain)

2. Reduce public expenditure (Explain)

Question. In India unemployment is a major problem, if aggregate demand is equal to aggregate supply, can it be called a situation of equilibrium?

Answer: Yes, but it will be underemployment equilibrium, and there exists a voluntary unemployment in an economy.

Question. Increase in money supply is an effective measure to control economic depression, but it creates the burden of borrowing on economy. Explain any two measures by which economic depression can be controlled even in the situation of increase in money supply.

Answer: (a) Decrease in bank rate. (Explain) (b) Decrease in statutory liquidity ratio (SLR) (Explain).

VIII.Applications Based Questions

Question. Depression is a high-handed monster, and if handled carefully it is not so troublesome. Comment.

Answer:

1. Depression reflects slowdown of economic activities on all fronts and therefore is a cause of concern for the government and society at large.

2. However, if tackled carefully taking appropriate monetary and fiscal measures, it may prove useful.

3. As it has happened in 1929 in America, and also in the years from 2008 to 2012 in the context of slowdown of the Indian economy.

Question. Small investors (such as households) deposit their savings to sustain their livelihood present and future, but government reduces interest rate for boosting economy. This is inequitable. How?

Answer:

1. Households mobilize their savings and deposits it in the banks to earn interest for meeting their current and future needs.

2. If there is a fall in the interest rate, they get less interest, and, hence, find it difficult to sustain their livelihood.

3. But, on the other hand, RBI thinks of reducing interest rate for boosting the climate of investment.

4. There is a contradiction between the two, because increase in investment promotes aggregate demand and output while savings is a leakage from flow of income, and it should be resolved in a manner so that no one suffers.

Question. Monetary measures controlling the situations of inflationary and deflationary gaps are confined only to regular and white transactions. They do not reflect the real situation. Comment.

Answer: In India, in unorganized sectors. Such as small industries and agriculture, there are vast activities relating to aggregate demand and aggregate supply which are not reflected while assessing the gaps. It is because of these activities that the slowdown effect, that affected a considerable part of the world in 2008, did not affect India

| NCERT Solutions Class 12 Economics Chapter 1 Introduction to Economics |

| NCERT Solutions Class 12 Economics Chapter 2 Demand |

| NCERT Solutions Class 12 Economics Chapter 2 Elasticity of Demand |

| NCERT Solutions Class 12 Economics Chapter 3 Cost |

| NCERT Solutions Class 12 Economics Chapter 3 Production |

| NCERT Solutions Class 12 Economics Chapter 4 Perfect Competition |

| NCERT Solutions Class 12 Economics Chapter 4 Producer Equilibrium |

| NCERT Solutions Class 12 Economics Chapter 4 Revenue |

| NCERT Solutions Class 12 Economics Chapter 4 Supply |

| NCERT Solutions Class 12 Economics Chapter 6 Non Competitive Market |

| NCERT Solutions Class 12 Economics Chapter 1 Introduction to Macroand its Concepts |

| NCERT Solutions Class 12 Economics Chapter 2 National Income and Related Aggregates |

| NCERT Solutions Class 12 Economics Chapter 3 Banking |

| NCERT Solutions Class 12 Economics Chapter 3 Money |

| NCERT Solutions Class 12 Economics Chapter 4 Aggregate Demand and Its Related Concepts |

| NCERT Solutions Class 12 Economics Chapter 4 National Income Determination and Multiplier |

| NCERT Solutions Class 12 Economics Chapter 5 Government Budget and the Economy |

| NCERT Solutions Class 12 Economics Chapter 6 Balance of Payment |

| NCERT Solutions Class 12 Economics Chapter 6 Foreign Exchange Rate |

NCERT Solutions Class 12 Economics Chapter 5 Excess Demand and Deficient Demand

The above provided NCERT Solutions Class 12 Economics Chapter 5 Excess Demand and Deficient Demand is available on our website www.studiestoday.com for free download in Pdf. You can read the solutions to all questions given in your Class 12 Economics textbook online or you can easily download them in pdf. The answers to each question in Chapter 5 Excess Demand and Deficient Demand of Economics Class 12 has been designed based on the latest syllabus released for the current year. We have also provided detailed explanations for all difficult topics in Chapter 5 Excess Demand and Deficient Demand Class 12 chapter of Economics so that it can be easier for students to understand all answers. These solutions of Chapter 5 Excess Demand and Deficient Demand NCERT Questions given in your textbook for Class 12 Economics have been designed to help students understand the difficult topics of Economics in an easy manner. These will also help to build a strong foundation in the Economics. There is a combination of theoretical and practical questions relating to all chapters in Economics to check the overall learning of the students of Class 12.

You can download the NCERT Solutions for Class 12 Economics Chapter 5 Excess Demand and Deficient Demand for latest session from StudiesToday.com

Yes, the NCERT Solutions issued for Class 12 Economics Chapter 5 Excess Demand and Deficient Demand have been made available here for latest academic session

Regular revision of NCERT Solutions given on studiestoday for Class 12 subject Economics Chapter 5 Excess Demand and Deficient Demand can help you to score better marks in exams

Yes, studiestoday.com provides all latest NCERT Chapter 5 Excess Demand and Deficient Demand Class 12 Economics solutions based on the latest books for the current academic session

Yes, NCERT solutions for Class 12 Chapter 5 Excess Demand and Deficient Demand Economics are available in multiple languages, including English, Hindi

All questions given in the end of the chapter Chapter 5 Excess Demand and Deficient Demand have been answered by our teachers