1. A manufacture sells a T.V to a dealer for Rs.18000 and the dealer sells it to a consumer at a profit of Rs 1500. If the sales are intra state and the rate of G.S.T is 12 %, Find:

(i) The amount of GST paid by the dealer to the State Government.

(ii) The amount of GST received by the Central Government.

(iii) The amount of GST received by the State Government.

(iv) The amount that the consumer pays for the TV.

Solution:

We have given that:

Manufacturer sells T.V to a dealer = ₹ 18000

Dealer sells it to consumer at a profit of = ₹ 1500

∴ SGST – CGST = ½ GST

As this transaction is intra-state so the dealer should pay SGST to state government and CGST to central government only on ₹ 1,500.

GST 12% = 6% CGST + 6% SGST [Given]

Amount of GST collected by manufacturer from dealer,

∴ CGST – SGST = 6% of 18000

= (6/100) × 18000

= ₹ 1080

∴ Manufacturer will pay ₹ 1080 as CGST and ₹ 1080 as SGST

Now, CP of a TV for dealer = ₹ 18000

Profit = ₹ 1500

SP of a TV for dealer to customer – CP + Profit

= ₹ 18000 + ₹ 1500

= ₹ 19500

Amount of GST collected by dealer from customer,

CGST = SGST = 6% of ₹ 19500

= (6/100) × 19500

= ₹ 1170

(i) The amount of tax paid by dealer to State Government

∴ GST collected by dealer from customer – SGST paid by manufacturer

= ₹ 1170 – ₹ 1080

= ₹ 90

(ii) The Amount of GST received by the Central Government.

∴ CGST paid by manufacturer + CGST paid by dealer

= ₹ 1080 + ₹ 90

= ₹ 1170

(iii) The Amount of GST received by the State Government.

∴ SGST paid by manufacturer + SGST paid by dealer

= ₹ 1080 + ₹ 90

= ₹ 1170

(iv) The Amount that the consumer pays for the TV.

∴ CP of TV + CGST paid by customer + SGST paid by customer

= ₹19500 + ₹1170 + ₹ 1170

= ₹ 21840

2. A shopkeeper buys a camera at a discount of 20% from a wholesaler. The printed price of the camera being Rs 1600. The shopkeeper tells it to a consumer at the printed price.

If the sales are intra-state and the rate of GST Is 12%, find:

(i) GST paid by the shopkeeper to the Central Government

(ii) GST received by the Central Government.

(iii) GST received by the State Government.

(iv) The amount at which the consumer bought the camera.

Solution:

We have given that:

As this transaction is intra-state of Goods & Services.

therefore SGST = CGST = ½ GST

We have given that :

Printed price of a camera

Rate of discount

∴ CP of camera for shopkeeper

= printed price – Rate of Discount

= ₹1600 – 20% of ₹1600

= ₹1600 – (20/100) × 1600

= ₹1600 – ₹320

= ₹1280

It is given that, rate of GST = 12%

The amount of input GST paid by the shopkeeper to the wholesaler,

CGST = SGST = 6% of ₹1280

= (6/100) × 1280

= ₹76.80

(i) The amount of output GST paid by the shopkeeper to the Central Government

CGST = SGST = 6% of ₹1600

= (6/100) × 1600

= ₹96

Now, the amount of GST paid by the shopkeeper to the Central Government

∴ Output CGST – Input CGST

= ₹96 – ₹76.80

= ₹19.20

Hence, GST paid by shopkeeper of the Central Government is ₹19.20

(ii) The amount of GST received by the Central Government.

∴ The amount of CGST paid by wholesaler + the amount of CGST paid by shopkeeper

= ₹76.80 + ₹19.20

= ₹96

Hence, the ₹96 of GST received by the Central Government.

(iii) The amount of GST received by the State Government.

∴ SGST paid by wholesaler + SGST paid by shopkeeper

= ₹76.80 + ₹19.20

= ₹96

Hence, the ₹96 of GST received by the State Government.

(iv) The amount at which the consumer bought the camera.

∴ The Amount paid by consumer for camera

= CP of camera + CGST paid by consumer + SGST paid by consumer

= ₹1600 + ₹96 + ₹96

= ₹1792

Hence, the amount at which the consumer bought the camera is ₹1792

3. A manufacturer sells a washing machine to a wholesaler for Rs . The wholesaler sells it to a trader at a profit of Rs. and the trader sells it to a consumer at a profit of Rs . If all the sales are intra-state and the rate of GST is %, find:

(i) The amount of tax (under GST) received by the State Government from the wholesaler.

(ii) The amount of tax (under GST) received by the Central Government from the trader.

(iii) The amount that the consumer pays for the machine.

Solution:

It is a case of intra-state transaction of goods and services.

SGST = CGST = ½ GST

Given:

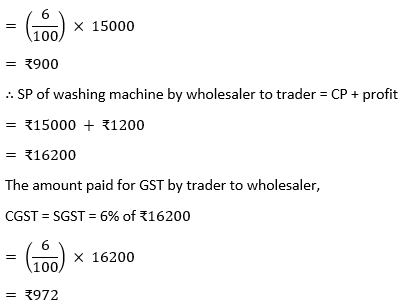

CP of washing machine for wholesaler = ₹15000

Rate of GST = 12%

∴ Amount of GST paid by wholesaler to manufacturer,

CGST = SGST = 6% of ₹15000

(i) The amount of tax (under GST) received by the State Government from the wholesaler.

₹972 – ₹900 = ₹72

(ii) The amount of tax (under GST) received by the Central Government from the trader.

∴ SP of washing machine for trader to consumer = CP of washing machine + profit

= ₹16200 + ₹1800

= ₹18000

Amount of GST paid by consumer to trader,

CGST = SGST = 6% of ₹18000

= ₹1080

∴ Amount of GST received by the Central Government from the trader

= ₹1080 – ₹972

= ₹108

(iii) The amount that the consumer pays for the machine.

CP of washing machine for consumer + CGST paid by consumer + SGST paid by consumer

= ₹15000 + ₹1080 + ₹1080 = ₹17160

4. A dealer buys an article at a discount of 30% from the wholesaler, the marked price being Rs 6000. The dealer sells it to a consumer at a discount of 10% on the marked price. If the sales are intra-state and the rate of GST is 5%. Find:

(i) The amount paid by the consumer for the article.

(ii) The tax (under GST) paid by the dealer to the State Government.

(iii) The amount of tax (under GST) received by the Central Government.

Solution:

It is a case of intra-state transaction of goods and services.

SGST = CGST = ½ GST

Given:

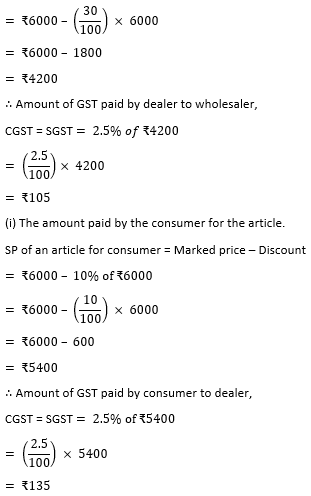

Marked price of an article = ₹6000

Given, Rate of GST = 5%

Rate of discount given by the wholesaler = 30%

∴ CP of an article for dealer = Marked price – Discount

= ₹6000 – 30% of ₹6000

∴ Amount paid by consumer for article =

CP of article for consumer + CGST paid by consumer + SGST paid by consumer

= ₹5400 + ₹135 + ₹135 = ₹5670

Hence, the amount paid for article by consumer ₹5670

(ii) The tax (under GST) paid by the dealer to the State Government.

₹135 – ₹105 = ₹30

(iii) The amount of tax (under GST) received by the Central Government.

CGST paid by wholesaler + CGST by dealer = ₹105 + ₹30 = ₹135

Hence, tax (under GST) received by the Central Government ₹135

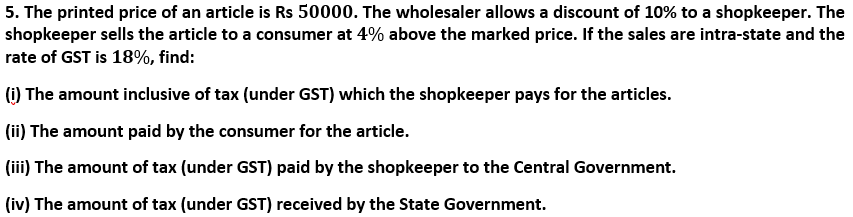

Solution:

It is a case of intra-state transaction of goods and services.

SGST = CGST = ½ GST

Given:

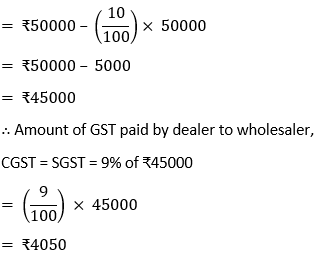

Marked price of an article = ₹50000

Rate of GST = 18%

(i) The amount inclusive of tax (under GST) which the shopkeeper pays for the articles.

Rate of discount given by the wholesaler = 10%

CP of an article for shopkeeper = Marked price – Discount

= ₹50000 – 10% of ₹50000

∴ Amount paid by shopkeeper for an article =

CP of an article for shopkeeper + CGST paid by consumer + SGST paid by consumer

= ₹45000 + ₹4050 + ₹4050 = ₹53100

(ii) The amount paid by the consumer for the article.

SP of an article for consumer = Marked price – Discount

= ₹50000 – 4% of ₹50000

= ₹50000 – (4/100) × 50000

= ₹50000 – 2000

= ₹48000

∴ Amount of GST paid by consumer to dealer,

CGST = SGST = 9% of ₹48000

= 9/100 × 48000

= ₹4320

∴ Amount paid by consumer for article =

CP of article for consumer + CGST paid by consumer + SGST paid by consumer

= ₹48000 + ₹4320 + ₹4320 = ₹56640

Hence, the amount paid for article by consumer is ₹56640

(iii) The amount of tax (under GST) paid by the shopkeeper to the Central Government.

₹4320 – ₹4050 = ₹270

(iv) The amount of tax (under GST) received by the State Government.

SGST paid by wholesaler + SGST paid by shopkeeper

= ₹4050 + ₹270 = ₹4320

Hence, the tax received by the State Govt. (Under GST) is ₹4320

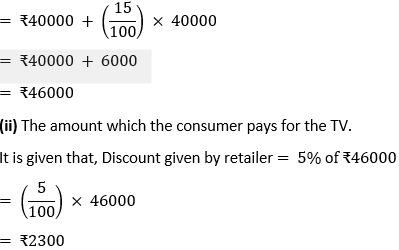

6. A retailer buys a TV from a wholesaler for Rs 40000. He marks the price of the T.V. 15% above his cost price and sells it to a consumer at 5% discount on the marked price. If the sales are intra-state and the rate of GST is 12%, find:

(i) The marked price of the TV.

(ii) The amount which the consumer pays for the TV.

(iii) The amount of tax (under GST) paid by the retailer to the Central Government.

(iv) The amount of tax (under GST) received by the State Government.

Solution:

As this transaction is intra-state of goods and services.

SGST = CGST = ½ GST

Steps by step explanation:-

Given:

(i) The marked price of the TV.

It is given that, Retailer buy TV for ₹40000

∴ Marked price of TV = ₹40000 + 15% of 40000

∴ Amount paid by consumer without GST for TV

= ₹4600 0 – ₹2300

= ₹43700

Given, Rate of GST = 12%

∴ Amount of GST paid by consumer = 12% of ₹43700

= ₹2622

∴ The amount of tax (under GST) paid by the retailer to the Central Government =

₹2622 – ₹2400 = ₹222

Hence, tax (under GST) paid by the retailer to the Central Government is ₹222

(iv) The amount of tax (under GST) received by the State Government.

SGST paid by wholesaler + SGST paid by shopkeeper

= ₹2400 + ₹222 = ₹2622

Hence, The amount of tax (under GST) received by the State Government is ₹2622.

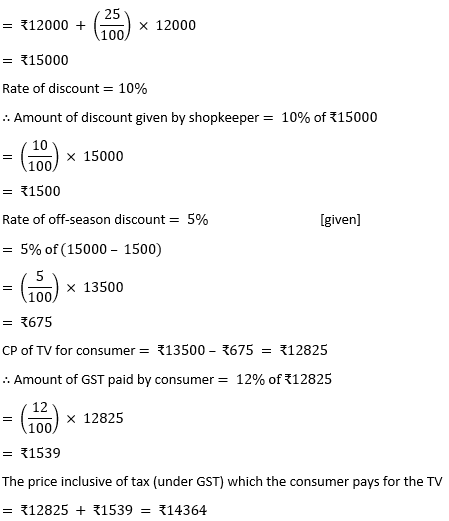

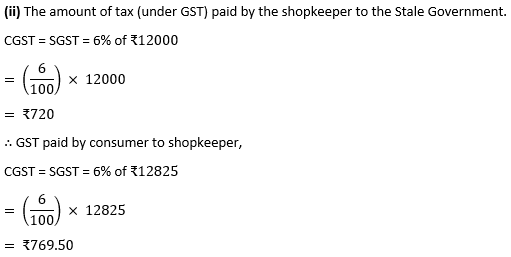

7. A shopkeeper buys an article from a manufacturer for Rs 12000 and marks up it price by 25%. The shopkeeper gives a discount of 10% on the marked up price and he gives a further off-season discount of 5% or, the balance to a customer of TV. If the sales are intra-state and the rate of CST is 12%, find:

(i) The price inclusive of tax (under GST) which the consumer pays for the TV.

(ii) The amount of tax (under GST) paid by the shopkeeper to the Stale Government.

(iii) The amount of tax (under CST) received by the Central Government.

Solution:

It is a case of intra-state transaction of goods and services.

SGST = CGST = ½ GST

Given:

(i) The price inclusive of tax (under GST) which the consumer pays for the TV.

CP of an article for shopkeeper = ₹12000

Rate of mark up in price =25%

∴ Marked price of article = ₹12000 + 25% of ₹12000

∴ The amount of tax (under GST) paid by the shopkeeper to the Stale Government =

₹769.50 – ₹720 = ₹49.50

(iii) The amount of tax (under CST) received by the Central Government.

CGST paid by manufacturer = ₹720

∴ CGST paid by shopkeeper = ₹769.50 – ₹720 = ₹49.50

Hence, The amount of tax (under CST) received by the Central Government =

₹720 + ₹49.50 = ₹769.50

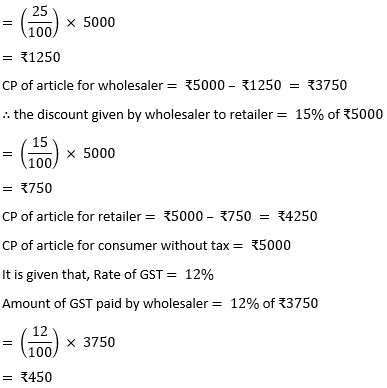

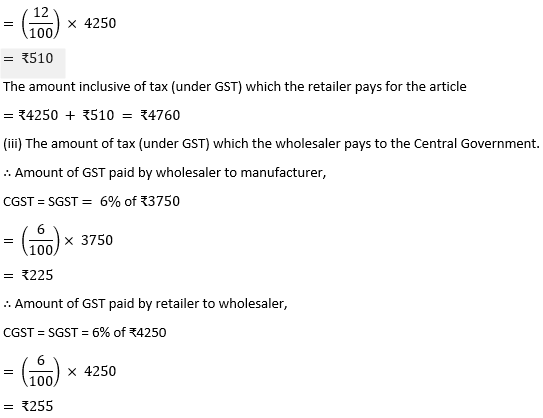

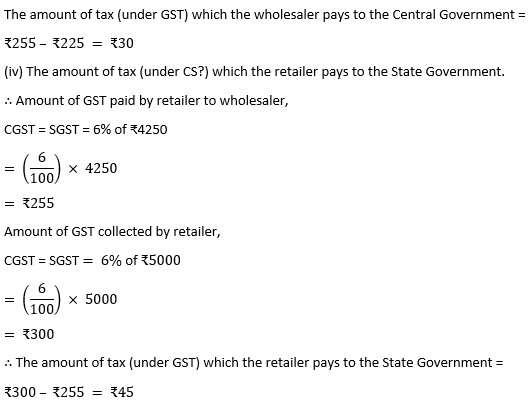

8. A manufacturer marks an article at Rs 5000, He sells it to a wholesaler at a discount of 25% on the marked price and the wholesaler sells it to a retailer at a discount of 15% on the marked price. The retailer sells it to a consumer at the marked price. If all the sales are intra-state and the rate of GST is 12%, find:

(i) The amount inclusive of tax (under GST) which the wholesaler pays for the article.

(ii) The amount inclusive of tax (under GST) which the retailer pays for the article.

(iii) The amount of tax (under GST) which the wholesaler pays to the Central Government.

(iv) The amount of tax (under GST) which the retailer pays to the State Government.

Solution:

As it is a case of intra-state transaction of goods and services.

SGST = CGST = ½ GST

Given:

(i) The amount inclusive of tax (under GST) which the wholesaler pays for the article.

A manufacture marked an article of ₹5000

∴ the Discount given by manufacturer = 25% of ₹5000

The amount inclusive of tax (under GST) which the wholesaler pays for the article =

₹3750 + ₹450 = ₹4200

(ii) The amount inclusive of tax (under GST) which the retailer pays for the article.

Amount of GST paid by retailer = 12% of ₹4250

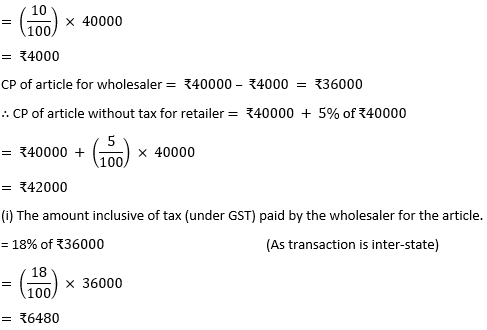

9. The printed price of an article is Rs 40000. A wholesaler in Uttar Pradesh buys the article horn a manufacturer in Gujarat at a discount of 10% on the printed price. The wholesaler sells the article to a retailer in Himachal at 5% above the printed price. If the rate of GST on the article is 18%, find:

(i) The amount inclusive of tax (under GST) paid by the wholesaler for the article.

(ii) The amount inclusive of tax (under GST) paid by the retailer for the article.

(iii) The amount of tax (under GST) paid by the wholesaler to the Central Government.

(iv) The amount of tax (under GST) received by the Central Government.

Solution:

Here, both given sales from manufacturer to wholesaler and wholesaler to retailer are inter-state.

So, CGST = SGST = 0

GST = IGST

Given:

The Printed price of an article = ₹40000

Discount given by manufacturer = 10% of ₹40000

∴ The amount inclusive of tax (under GST) paid by the wholesaler for the article = ₹36000 + ₹6480 = ₹42480

(ii) The amount inclusive of tax (under GST) paid by the retailer for the article.

= 18% of ₹42000

= (18/100) × 42000

= ₹7560

∴ The amount inclusive of tax (under GST) paid by the retailer for the article =

₹42000 + ₹7560 = ₹49560

(iii) The amount of tax (under GST) paid by the wholesaler to the Central Government.

= 18% of ₹36000

= (18/100) × 36000

= ₹6480

The Amount of GST paid by retailer to wholesaler = 18% of ₹42000

= 18100× 42000

= 18/100 × 42000

= ₹7560

∴ The amount of tax (under GST) paid by the wholesaler to the Central Government =

₹7560 – ₹6480 = ₹1080

(iv) The amount of tax (under GST) received by the Central Government.

IGST paid by wholesaler to the Central Government = ₹1080

IGST paid by manufacturer = ₹6480

∴ The amount of tax (under GST) received by the Central Government

= ₹1080 + ₹6480

= ₹7560

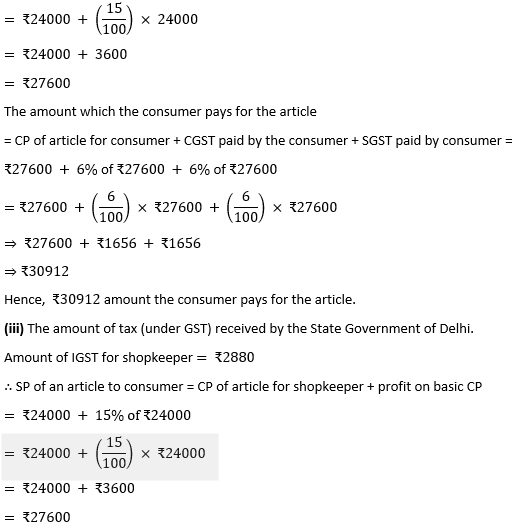

10. A shopkeeper in Delhi buys an article at the printed price of Rs 24000 horn a wholesaler in Mumbai. The shopkeeper sells the article to a consumer in Delhi at a profit of 15% on the basic reel price. if the rate of GST is 12%, find:

(i) The price inclusive of tax (under GST) at which the wholesaler bought the article.

(ii) The amount which the consumer pays for the article.

(iii) The amount of tax (under GST) received by the State Government of Delhi.

(iv) The amount of tax (under GST) received by the Central Government.

Solution:

(i) The price inclusive of tax (under GST) at which the wholesaler bought the article.

CP of an article for shopkeeper = ₹24000 [given]

Rate of GST = 12% [given]

∴ IGST collected by wholesaler from shopkeeper = 12% of ₹24000

= (12/100) × 24000

= ₹2880

The price inclusive of tax (under GST) at which the wholesaler bought the article =

CP of article for shopkeeper + IGST paid by shopkeeper to wholesaler

= ₹24000 + ₹2880

= ₹26880

Hence, the price inclusive of tax (under GST) at which the wholesaler bought the article is ₹26880

(ii) The amount which the consumer pays for the article.

CP of an article for shopkeeper = ₹24000 [given]

Profit on CP of article = 15% of CP

SP of an article by the shopkeeper to consumer = CP + Profit

= ₹24000 + 15% of ₹24000

Now, As the shopkeeper sells an article to consumer in Delhi; so this sales is Intra-state sales.

Amount of GST collected by shopkeeper from consumer,

CGST = SGST = 6% of ₹27600

= 6/100 × ₹27600

= ₹1656

The Amount of tax paid by shopkeeper to state govt. of Delhi

⇒ ₹2880 – ₹1656 = ₹1224

⇒₹1656 – ₹1224 = ₹432

(iv) The amount of tax (under GST) received by the Central Government = IGST received from wholesaler + CGST received from shopkeeper

= ₹2880 + NIL = ₹2880

Hence, the amount of tax (under GST) received by the Central Government is ₹2880

11. Kiran purchases an article for Rs 5310 which includes 10% rebate on the marked price and 18% tax (under GST) on the remaining price. Find the marked price of the article.

Solution:

Let the marked price be x

10% rebate on the marked price gives [given]

After rebated price = Marked price – 10%

= x – 10% of x

= 5000

Hence, the required marked price of an article is ₹5000

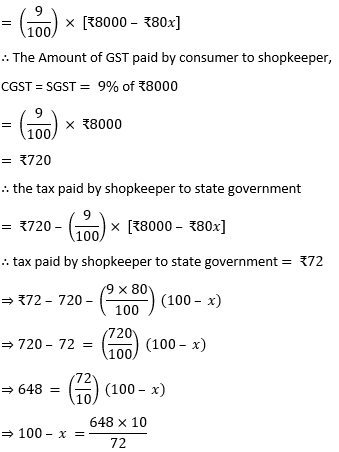

12. A Shopkeeper buys an article whose list price is Rs 8000 at some rate of discount from the wholesaler. He sells the article to a consumer at the list price. The sales are intra-state and the rate of GST is 18%. If the shopkeeper pays a tax (under GST) of 72 to the State Government, find the rate of discount at which he bought the article from the wholesaler.

Solution:

Given:

List of price of an article = ₹8000

Let the rate of discount given by wholesaler be x%

So,

Discount = x% of ₹8000

= (x/100) × ₹8000

= ₹80x

Now, CP of an article for shopkeeper

= ₹8000 – ₹80x

CP of article for consumer = ₹8000 {given}

Since the sales are intra-state, rate of GST = 18%

CGST = SGST = 9%

The Amount of GST paid by shopkeeper to wholesaler,

SGST = CGST = 9% of [₹8000 – ₹80x]

⇒100 – x = 90

⇒x = 100 – 90

⇒10

Hence, the required rate of discount = 10%